In ‘Anna Karenina,’ Leo Tolstoy says, “Happy families are all alike; every unhappy family is unhappy in its own way.” In trading, every profitable trader, no matter their trading strategy, will tell you the same thing – risk management is key.

While your trading execution should be based on sound fundamental and technical analyses, in the end, you can’t know with absolute certainty what the price action will be throughout your trade. Limiting your downside is the only thing within your control as a trader. Make sure that whichever direction the market goes, you have no significant exposure that will blow up your account. That’s the stated mission of risk management.

Let’s see how you can implement various risk management measures when trading.

What is Risk Management in Trading?

By definition, risk is the uncertainty revolving around a potential outcome. In trading, the primary risk you’ll face is market volatility, which may present a downside to your expected profitability. In this case, the risk is the amount you are willing to lose in a single trade, which is determined by the distance between your entry and the stop loss level.

Risk management means deploying strategies designed to limit your exposure to market risks such as volatility. Effectively, these strategies give you a mathematical advantage over time – not just to ensure that you weather all the potential losses but that you are profitable.

Risk Management Strategies in Trading

Every trader knows that they need to get a handle on risk management but don’t ask the right questions or focus on what’s needed for a positive expectancy. Trading is about probability analysis in uncertain conditions. And since no trading strategy has a 100%-win rate, the question becomes, how do you ensure that the losses don’t wipe you out? Here are the risk management strategies you can deploy.

Use Stop Loss Orders and Profit Targets

Think of these two as insurance for your open positions, especially in times of heightened volatility. Stop loss orders simply limit your downside; they allow you to cut your losses at acceptable levels before the losses become too large. You can also use trailing stops, which guarantee that even if the asset doesn’t reach the take profit target, you still keep the accumulated profits. Trailing stops are the easiest way to protect profits and eliminate the risk of losing trade once the trade is profitable. While there’s no such thing as a risk-free trade, this is as close as you can get to one.

On the other hand, profit targets lock in gains ensuring you exit the trade at a profit. It also eliminates the need for constant market monitoring and the temptation to hold out for potentially higher gains. While you can arbitrarily choose your stop loss and profit targets, they must be guided by proper technical analysis.

Ideally, consider your risk tolerance and the asset’s volatility when setting these levels. We’ll discuss these next.

The 2% Rule

Most risk management strategies in day trading are subjective. However, with capital allocation, you only need to remember to never use more than 2% of your account equity at risk. Say you have a $10,000 trading account. With the 2% rule, you only risk $200 per trade. In this case, you’ll need 50 losing trades in a row to wipe out your account – the probability of this happening is slim to none.

Note that the 2% rule will also prevent your positions from being closed by stop out in times of higher volatility. Your equity is protected from significant drawdowns by preventing overexposure to any single trade. Depending on your risk tolerance and trading strategy, the 2% threshold could be flexible. The idea here is to choose and stick with a percentage you’re comfortable with. Let’s move on to the third aspect of risk management in trading – the risk-reward trade-off.

Optimal Risk-Reward (RR) Trade-off

The risk/reward ratio in trading is a mathematical comparison of the expected return from a trade versus the amount you could lose should the trade not go in your favor. It evaluates the dollar-for-dollar potential gains against the potential losses. For example, a risk-reward ratio of 1.0 means that for every potential $1 profit you could make, you stand to lose $1. Why is any of this important?

Remember that no trading strategy has a 100% win rate. Here are two options to consider:

1. Higher risk-reward ratio

Let’s take an example of an RR of 2.0. That implies a potential $2 reward for every $1 at risk. From a trading strategy perspective, having a higher RR means you could be profitable even with a trading strategy with a lower win rate. You may need fewer but larger winning trades to be profitable.

2. Lower risk-reward ratio

Let’s use an example of an RR of 0.5. That means you only have a $0.5 potential profit from every $1 at risk. In this case, you’ll have smaller gains with each trade, and the possibility of successful trades increases since profit targets are closer. However, your trading strategy needs to have a higher win rate since you may need to execute more trades to be consistently profitable.

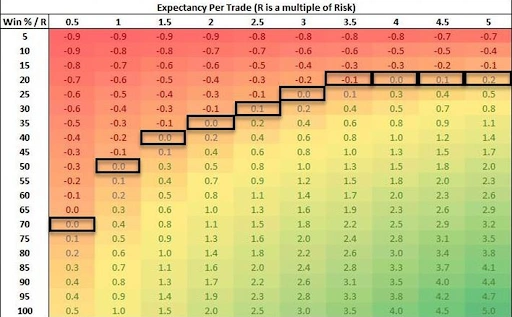

These two options underscore the importance of finding a suitable risk/reward trade-off based on your trading strategy. Here’s an expectancy table based on the profitability of your trading strategy and risk reward.

Backtesting your Trading Strategies

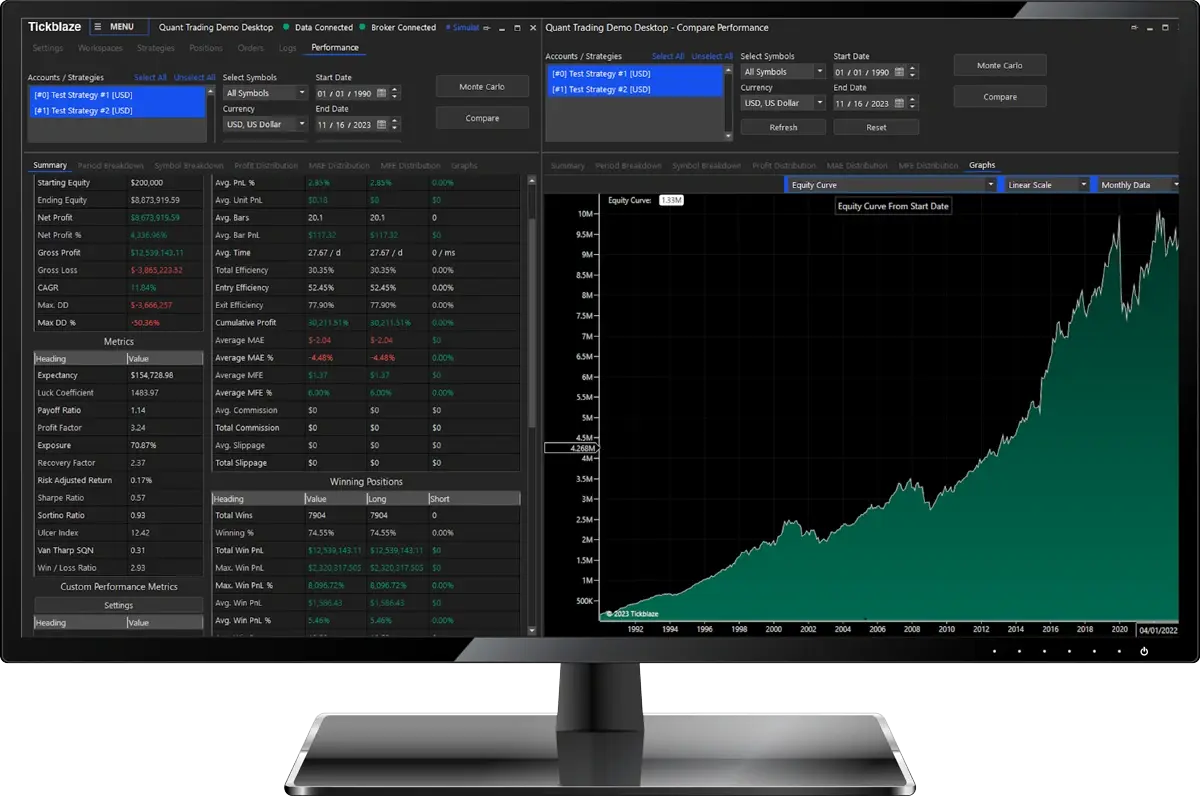

Backtesting your trading strategies allows you to evaluate their profitability ratio and simulate various scenarios with different risk-reward levels. You can determine your optimal capital allocation and appropriate risk-reward for each trade by evaluating the worst-case scenarios with your preferred trading strategy. It’s worth noting here that backtesting may not fully account for every possible variable in the market, and

While backtesting can help you determine the profitability of your trading strategy, that isn’t the primary goal here. When it comes to risk management, backtesting is meant to identify the worst-case scenario and account for them in your future trades with optimal risk-reward trade-off and proper capital allocation.

The Bottom Line

Every financial trading service provider issues the warning “Trading in financial markets involves significant risk, and traders can lose all their investment…” or a statement to that effect. That’s because you cannot avoid risk in trading – every trade you execute could be a losing trade.

It doesn’t matter how often you lose, it’s the size of the loss that matters. Every successful trader has a losing streak – after all no trading strategy is 100% accurate – but in the long run, they are profitable because the size of their gains far exceeds that of their losses. For you to thrive and become profitable as a trader, you must first survive any short-term losses. Risk management with proper capital allocation and optimal risk-reward trade-off gives you enough breathing room to ensure that these short-term losses don’t blow up your account.

DISCLAIMER

NeuroStreet (and all corporate and/or subsidiary brands) has no financial interest in the outcome of any trades mentioned herein. There is a substantial risk of loss when trading securities. You are solely responsible for all decisions regarding purchase or sale of securities (futures, forex, stocks, options, crypto), suitability, and your own risk tolerance. Choosing to engage in any of the products or services demonstrated presumes you have fully read and understood the risk involved in trading as set forth herein. There may be tax consequences for short-term profits or losses on trades. Consult your tax professional or advisor for details on these if applicable. Neither NeuroStreet (and all corporate and/or subsidiary brands), nor its principles, contractors or employees are licensed brokers or advisors.

NeuroStreet (and all corporate and/or subsidiary brands) offers services and products for educational purposes only. Market recommendations are not to be construed as investment or trading advice. You acknowledge that you enter into any transactions relying solely on your own judgment. Any market recommendations provided are generic only and may or may not be consistent with the market positions or intentions of NeuroStreet (and all corporate and/or subsidiary brands) or its affiliates. Any opinions, news, research, analysis, prices, or other information contained on our website or by presentation of our material is provided as general market commentary, and do not constitute advisory services.

All testimonials provided are the personal experiences of individual users and are not representative, nor do they constitute any guarantees or expectation of future performance. Results are not typical and have not been verified. All testimonials are to be considered for informational purposes only and should not be construed as investment or trading advice.

CFTC RULE 4.41 – Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

NOT INVESTMENT OR TRADING ADVICE | INFORMATIONAL AND EDUCATIONAL PURPOSES ONLY

Author Note:

This article was written by an independent communications consultant engaged by NeuroStreet. The author is not a licensed financial advisor or broker and does not provide trading, investment, or financial advice. All information has been prepared using materials provided by the client and is intended solely for educational and informational purposes.