The Hybrid Trading Platform

Standard & Strategy Desktops Available

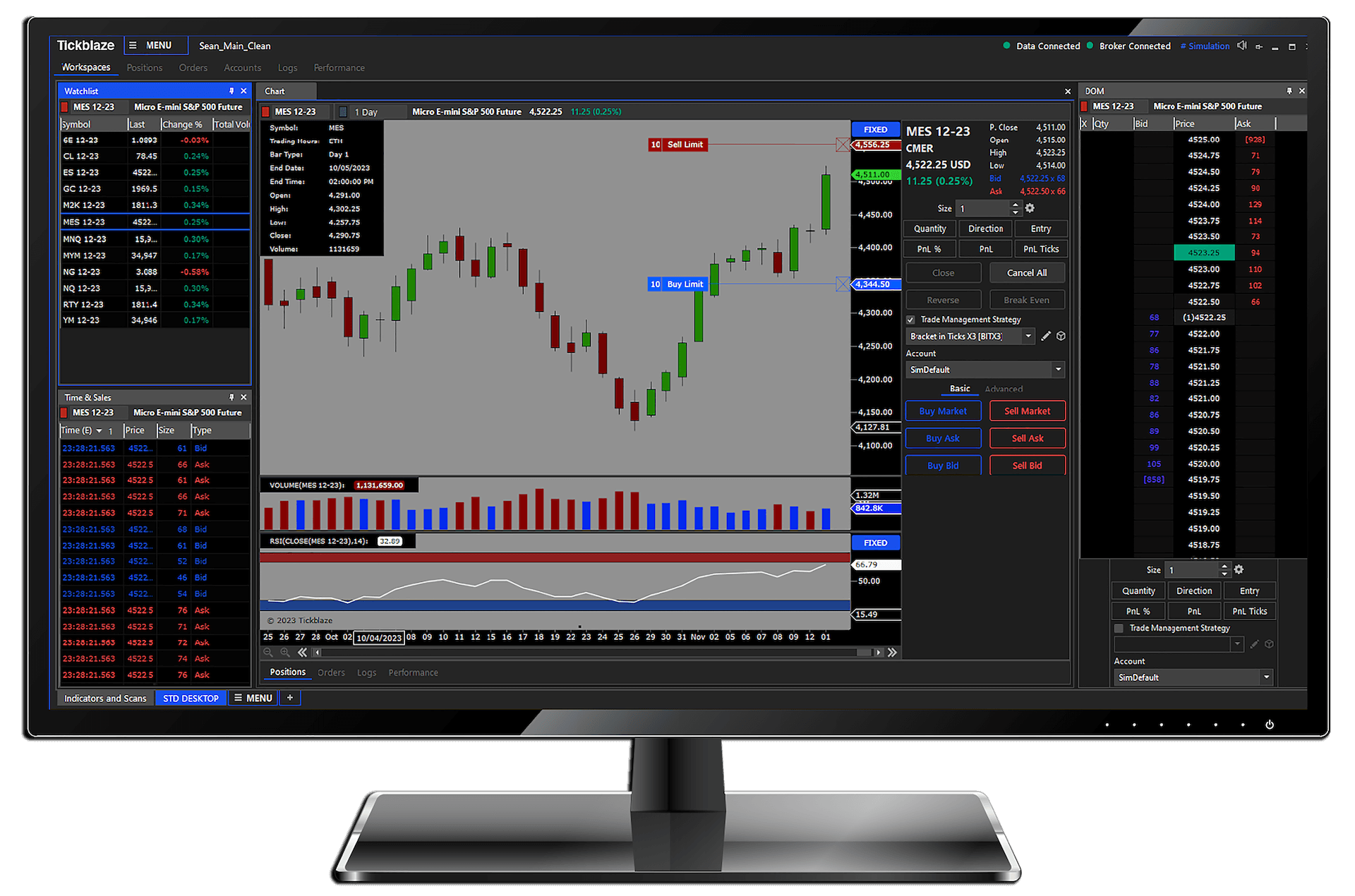

STANDARD DESKTOP

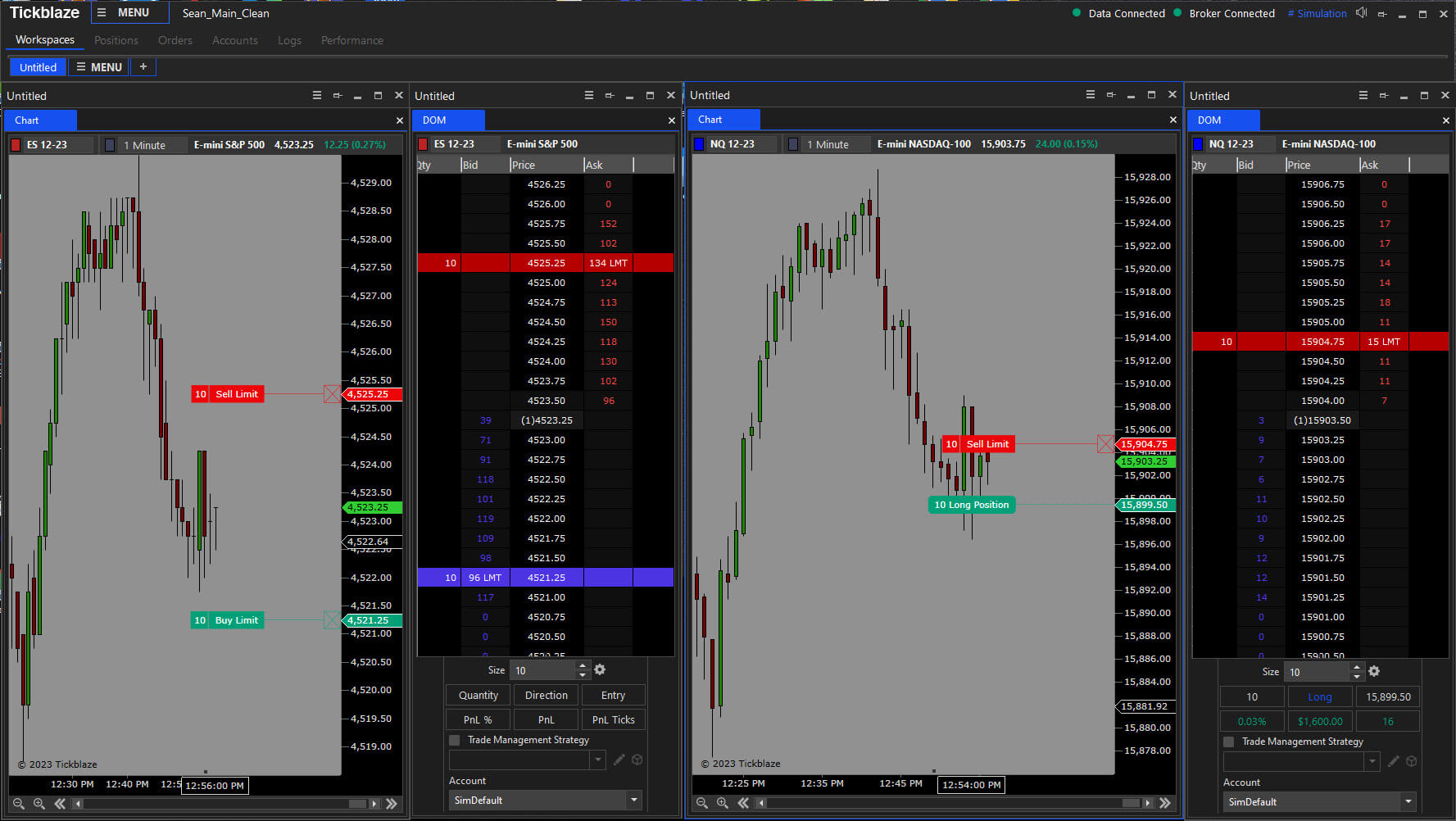

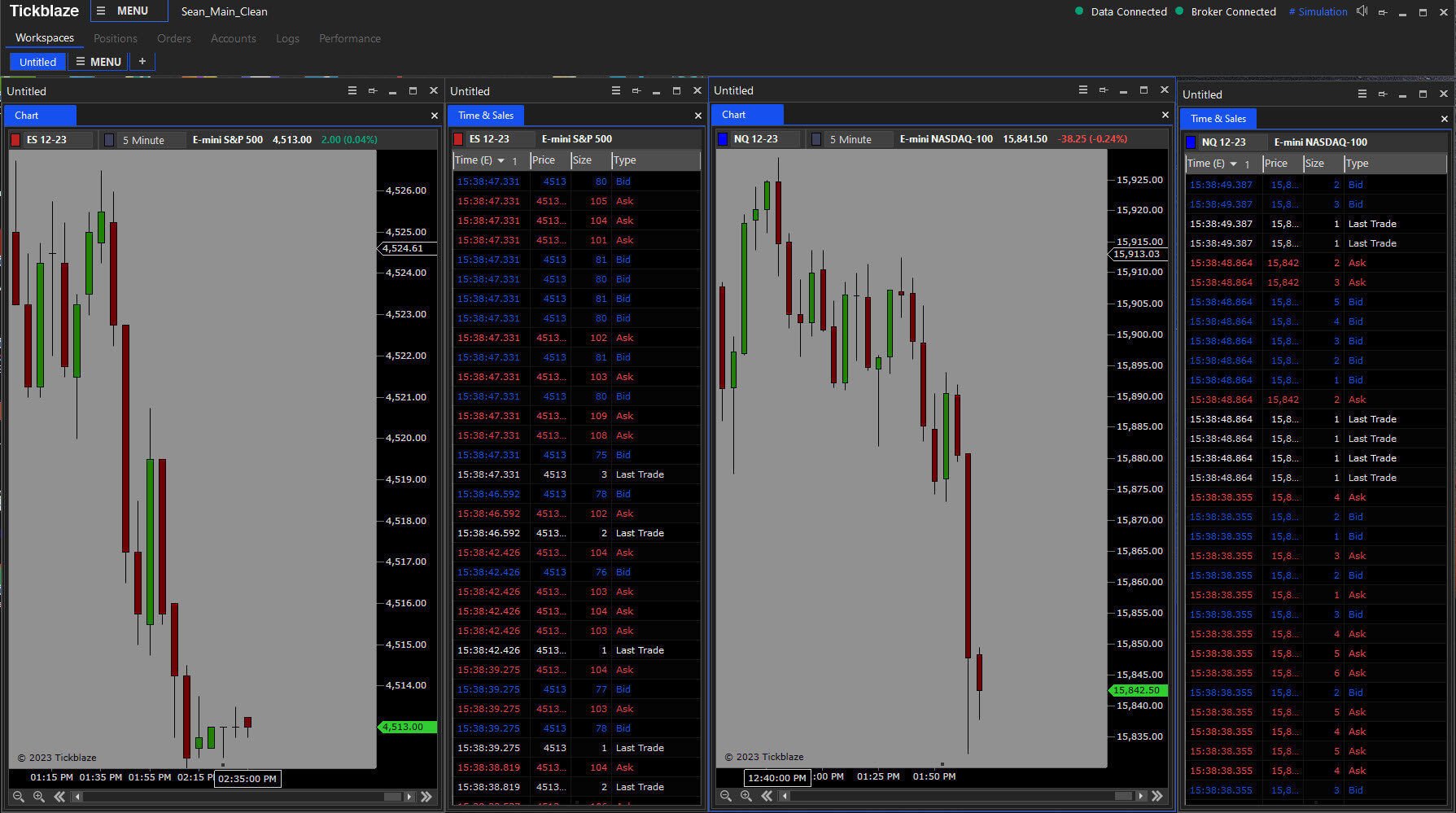

Discover a user-friendly trading experience with our Standard Desktop – the ultimate solution for discretionary traders. Boasting a custom user interface, intuitive order management, flexible chart trading, and custom trade management strategies, our platform simplifies the tech complexities of trading. Combined with unique charting tools, a robust indicator library, DOM trading, time and sales, watchlists, and scanning functionalities, we make trading easy, allowing you to focus on your strategies and success.

Standard Desktop - Discretionary Trading

Dual User InterfacePosition & Order ManagementBasic & Advanced Chart TradingTrade Managment StrategiesDrawing Tools & SignalsIndicator Library (200+)DOM TradingTime & SalesWatchlists, Scannning & Alerts

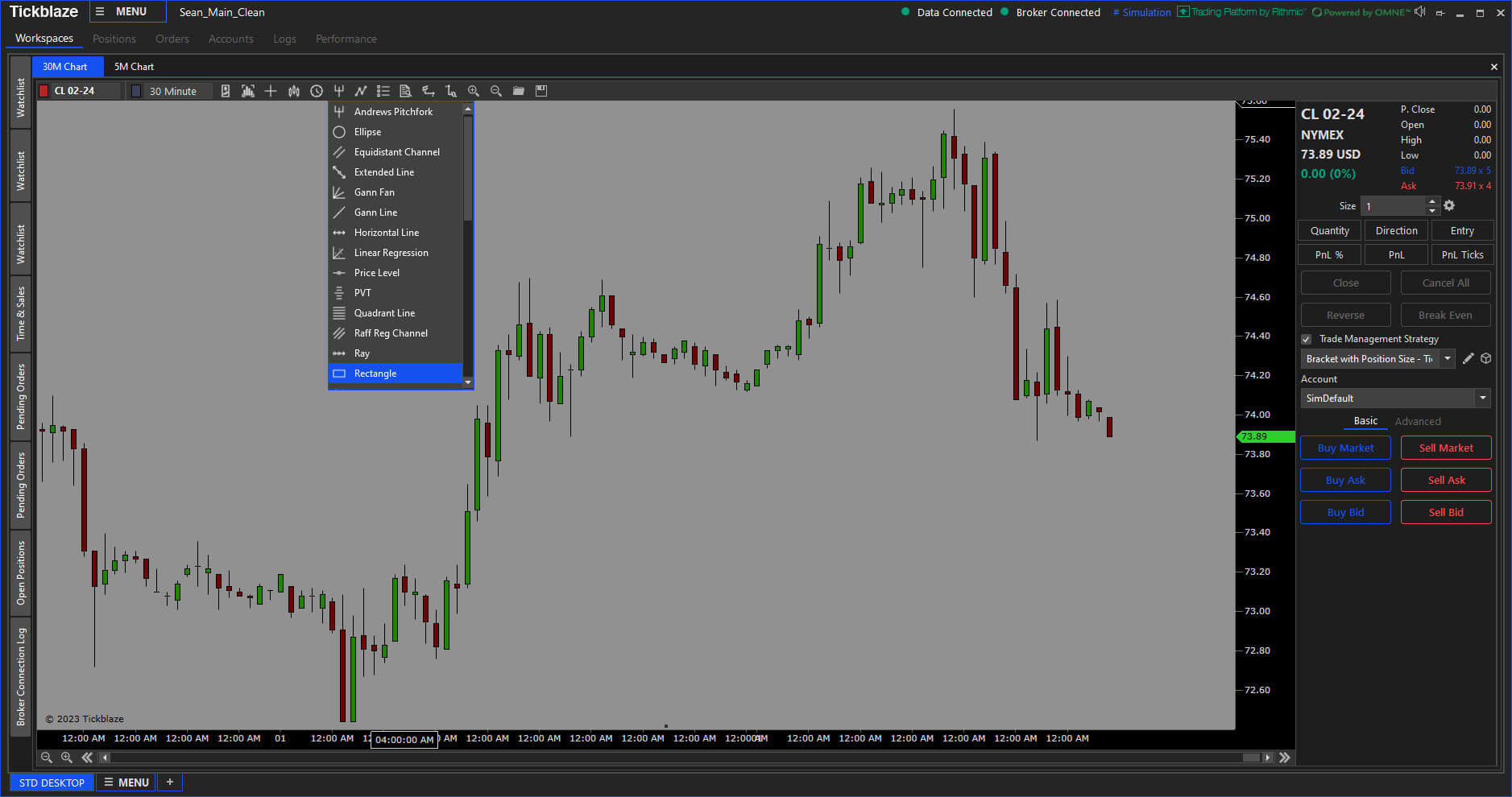

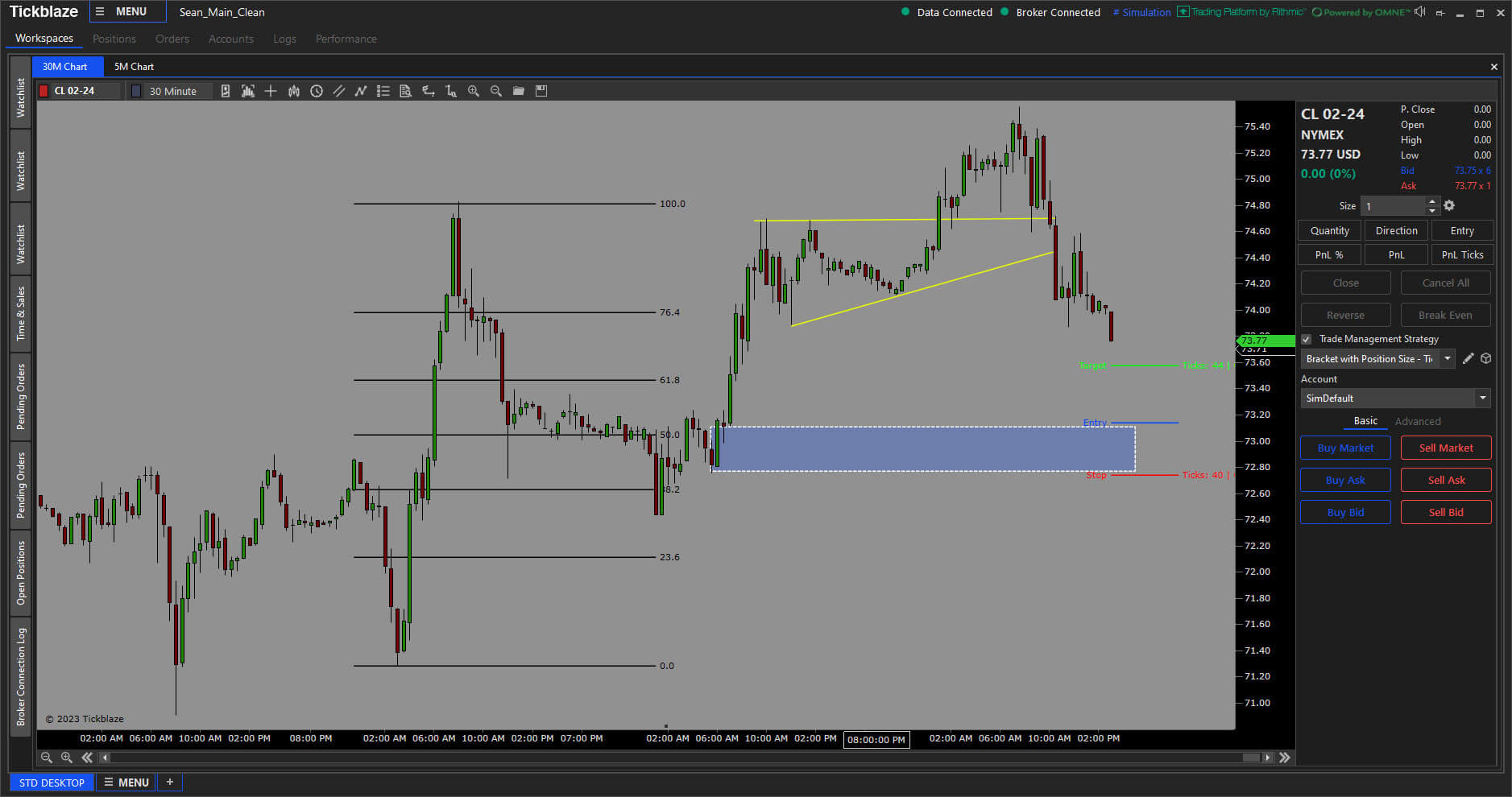

Basic & Advanced Chart Trading

(Click to enlarge image)

- User-Friendly Chart Trading & Execution

- Advanced Visual Order Entry (Drag and Drop)

- Visually Place Orders and Manage Trades

- Pre Plan Trades In Advance With Chart Trading Flags

- One Click Trade Entry & Exits (Directly On Charts)

- Custom Trade Execution with Visual Bracket Orders & Scripts

Comprehensive Indicator Library (200+)

(Click to enlarge image)

- Trend Indicators

- Momentum Indicators

- Volatility Indicators

- Volume Indicators

- Oscillators

- Orderflow & Print Analysis (coming soon)

- SMC, Orderblocks & FVG’s (coming soon)

- Price Action Indicators

- Supply & Demand (coming soon)

- Plus 100+ more advanced scripts

- Support and Resistance

- Cycle Indicators

- Volume & TPO Profiling (coming soon)

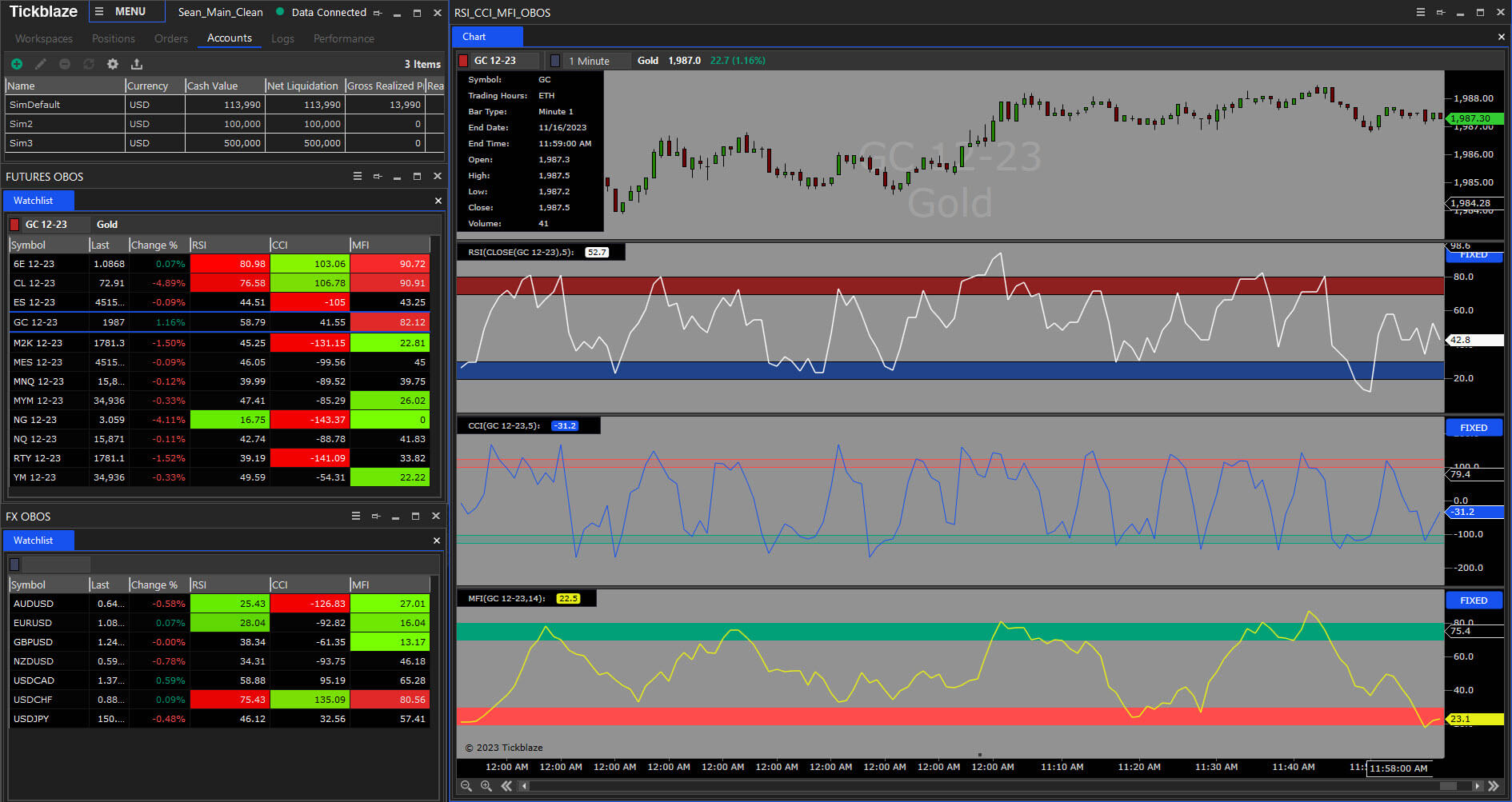

Watchlists, Scanning & Alerts

(Click to enlarge image)

- Comprehensive Market Monitoring

- Custom Asset Class Watchlists (Stocks, Futures, FX, Crypto)

- Indicator, Alerts, and Filters Integration

- Asset-Specific Scanning & Indicator Sorting

- Real-Time Market Insights & Price Scanning Capabilities

- Signals and Scans for Custom Trade Filtering

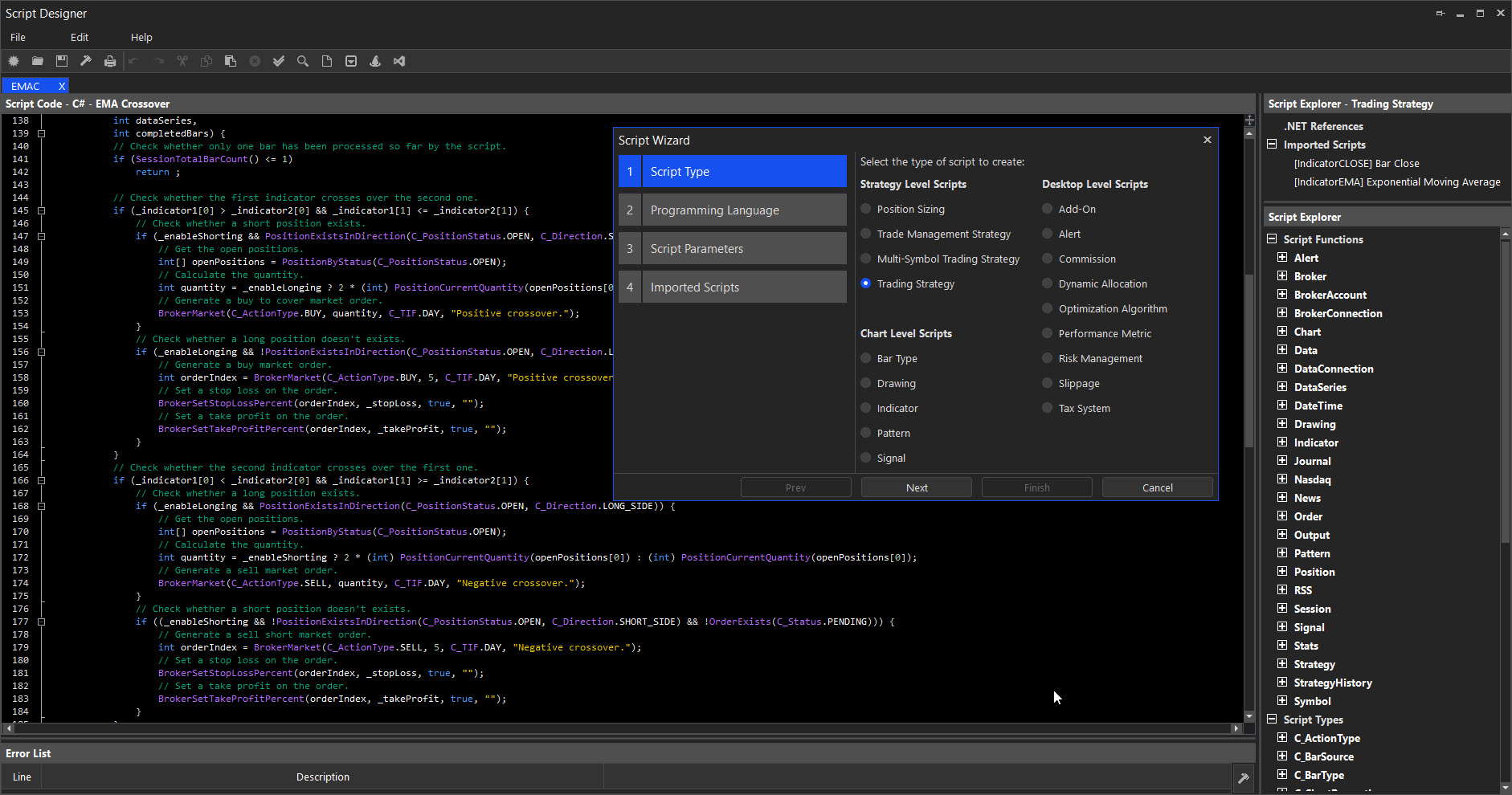

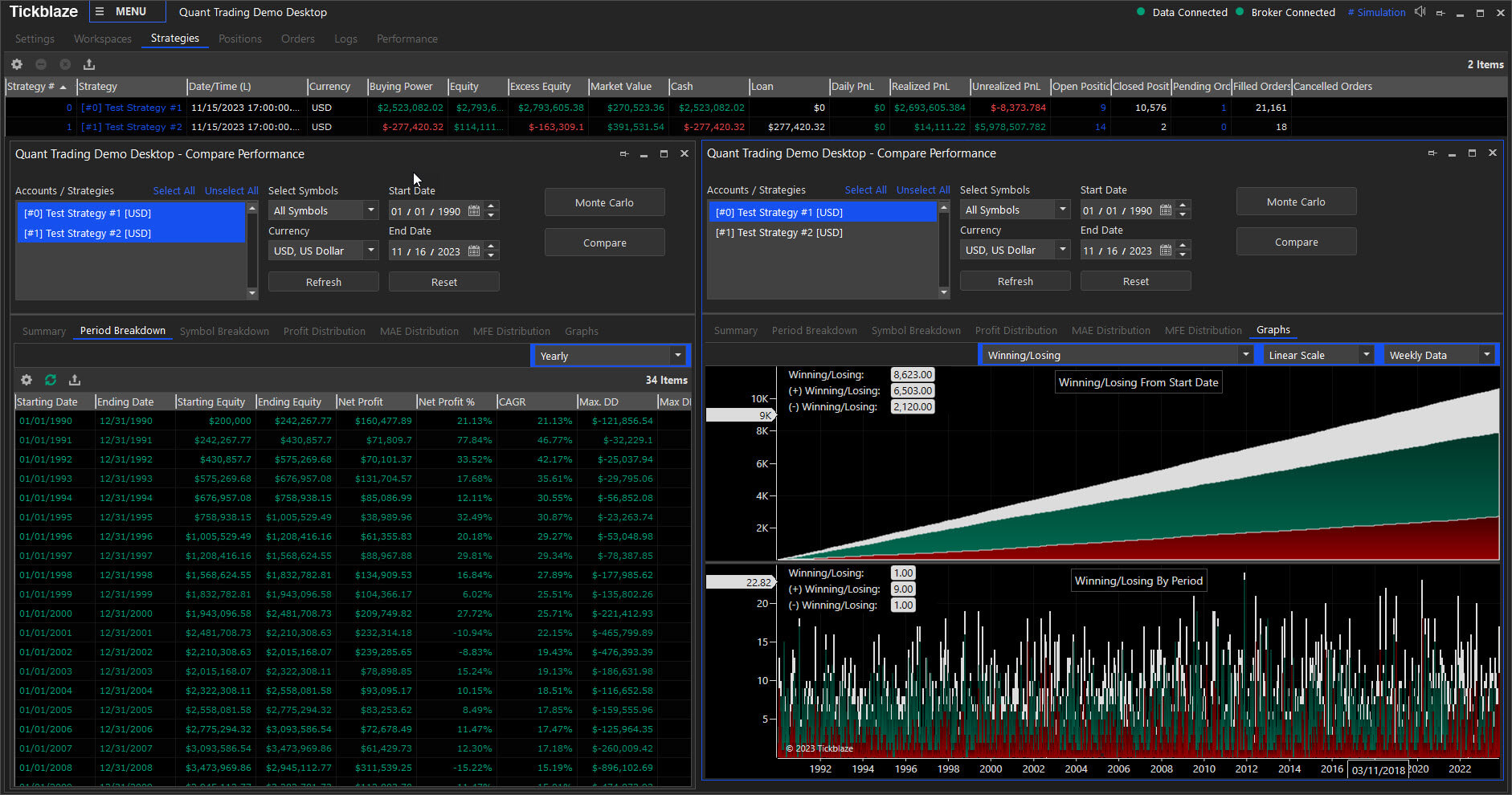

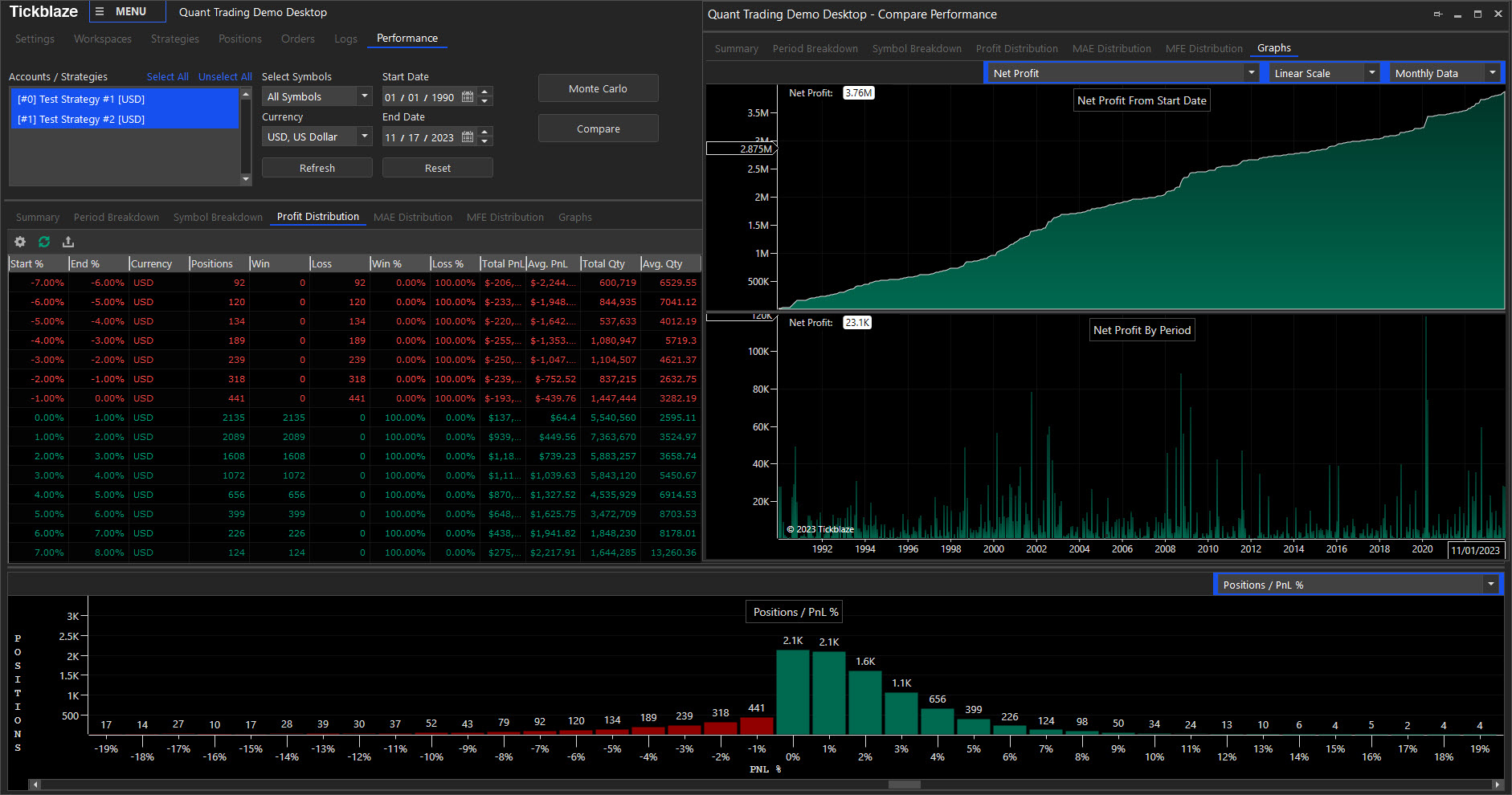

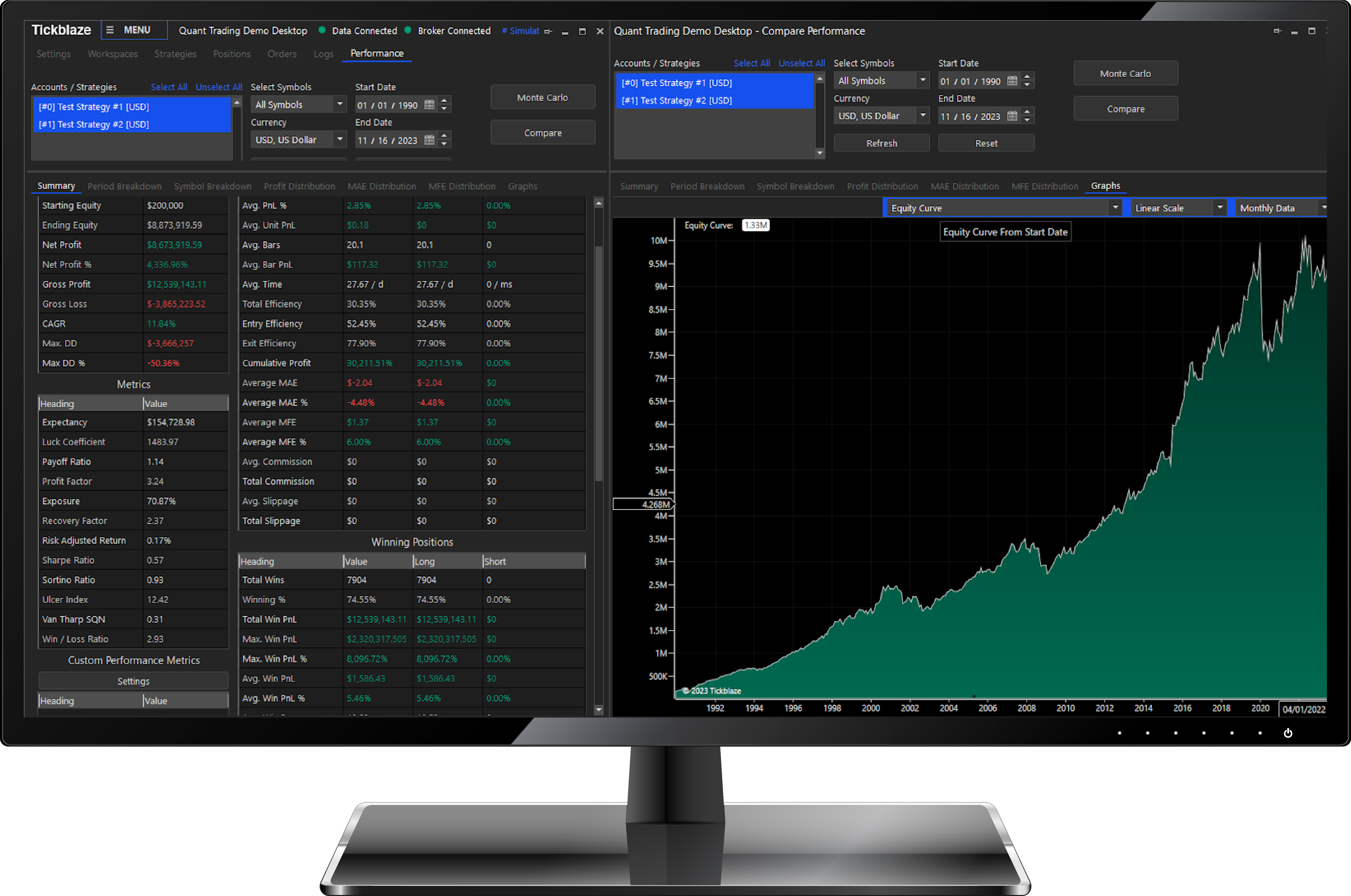

STRATEGY DESKTOP

Unleash the power of hybrid trading with our strategy Desktop – the ultimate solution for strategy traders. Engineered for precision, it excels in strategy development, backtesting, optimization, and execution. Harness the advanced strategy wizard for seamless design, monitor performance KPIs, and leverage portfolio capabilities. Whether you prefer desktop or cloud-based solutions, our platform empowers you with the tools to elevate your trading strategies to new heights.

Strategy Desktop Trading

Strategy DevelopmentStrategy BacktestingStrategy OptimizationStrategy ExecutionAdvanced Strategy WizardPerformance Metrics & VisualsPortfolio Capabilities

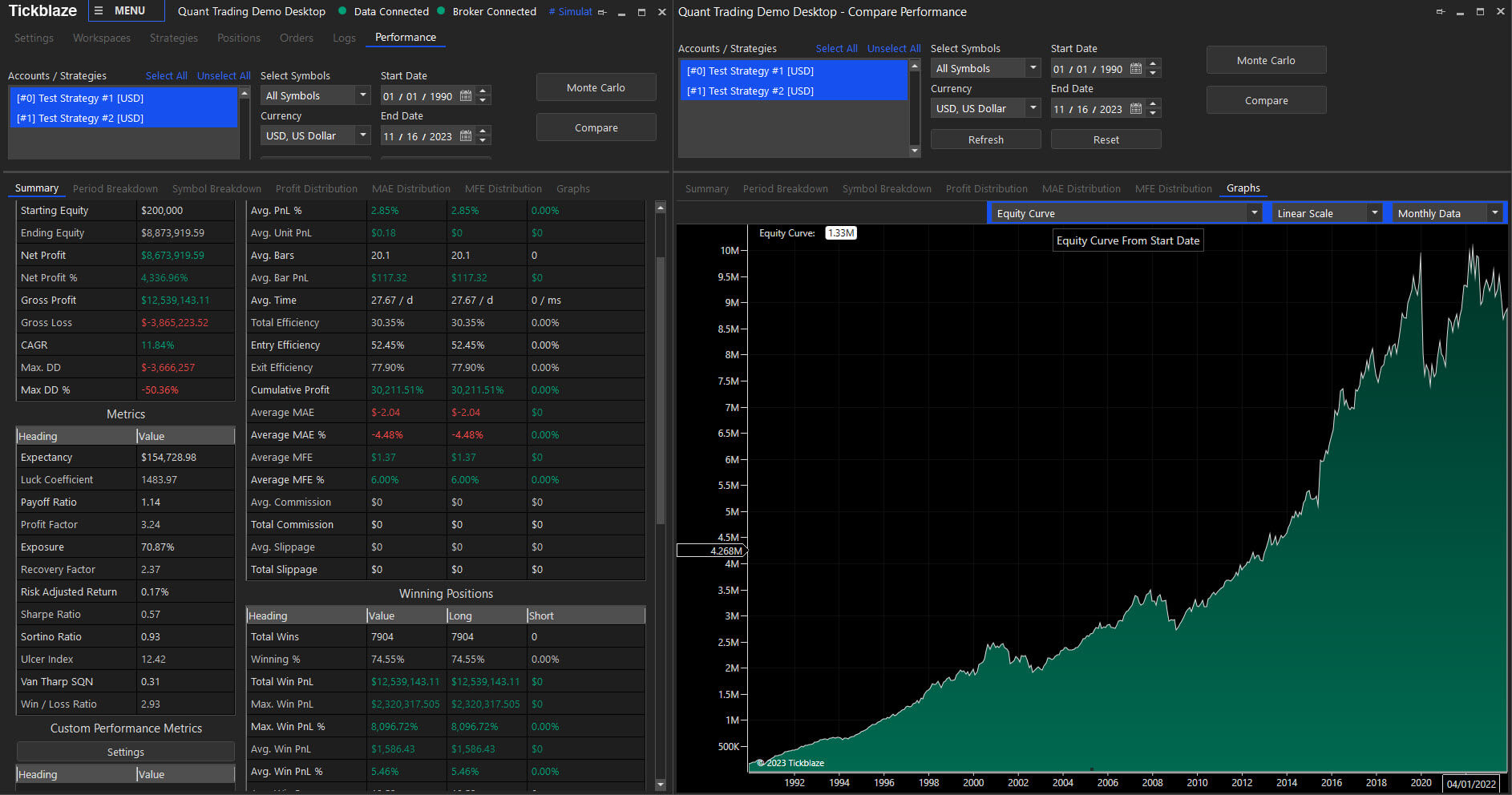

Strategy Backtesting

(Click to enlarge image)

- Evaluate Strategy Performance prior to trading live

- Mitigate Risk Via Performance Comparisons

- Make data-driven decisions before trading

- Blazing Fast Backtesting

- Build Strategy Confidence using data

- Perform scenario analysis under changing conditions

- Refine your strategy and alpha based on backtesting

- Supports Large Datasets

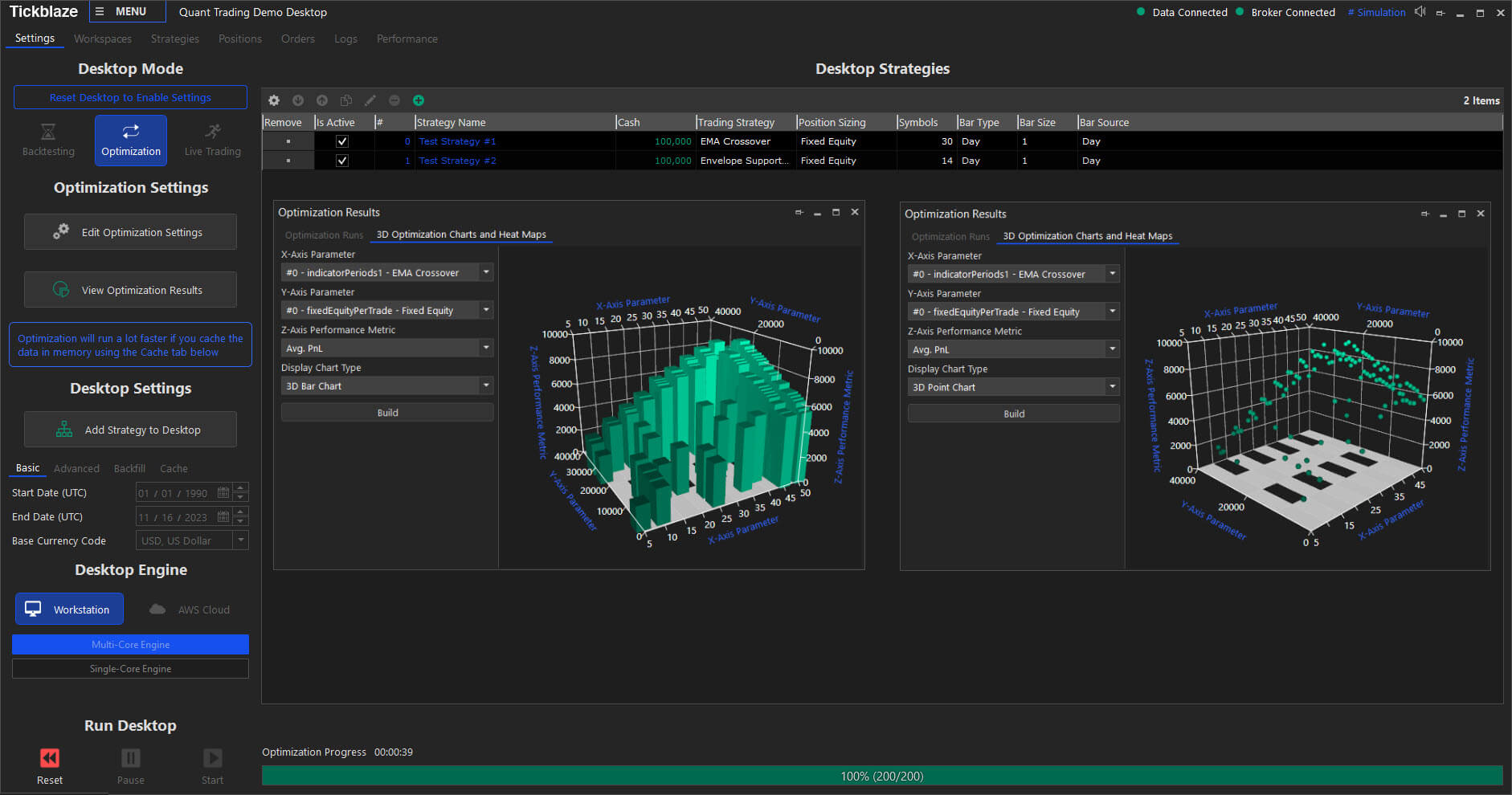

Strategy Optimization

(Click to enlarge image)

- Enhance strategy performance via optimization

- Increase Consistency & Mitigate Risk

- Prepare for adaptability & market changes

- Improve Risk-Adjusted Returns

- Blazing fast Optimisation

- Continuous Performance Monitoring

- Strategy Refinement Driven By Data

- Walk Forward & Monte Carlo Testing

- Find Optimal strategy parameters

For a detailed list of (Open Source) scripts and features CLICK HERE

Advanced Software Powered by ARC AI Developments

Coming Very Soon!

Tickblaze is integrating the industry’s top signals and indicators to offer the

most sophisticated product line any trading platform has ever seen.

For more information on the ARCS-AI products line Click Here.

Volume Profile

Macro Profiles is an all-inclusive multi-timeframe profile arbitrage trading solution. Using Daily, Weekly & Monthly profiles, you can now locate volume-based Support & Resistance trading zones that offer low risk highly accurate trading opportunities.

Smart Money Concepts

The SMC (Smart Money Concepts) is a Market Structure & Orderblock trading system.

OrderFlow

The Print Profiler is a Hybrid tool that combines orderflow footprint and volume profile. The orderflow footprint tracks multiple variations of orderflow and trade signal features.

Supply / Demand

UniZones is a universal price level and trading tool which locates key areas of interest (AOI’s) and trade setups based on Price Action and Market Structure.