Introduction to Volume Profile for Discretionary Traders

Understanding the volume profile is crucial for discretionary traders seeking to analyze market structure and price movements more effectively. This guide will introduce you to the fundamental concepts of volume profile trading and how it can be integrated into your trading strategy.

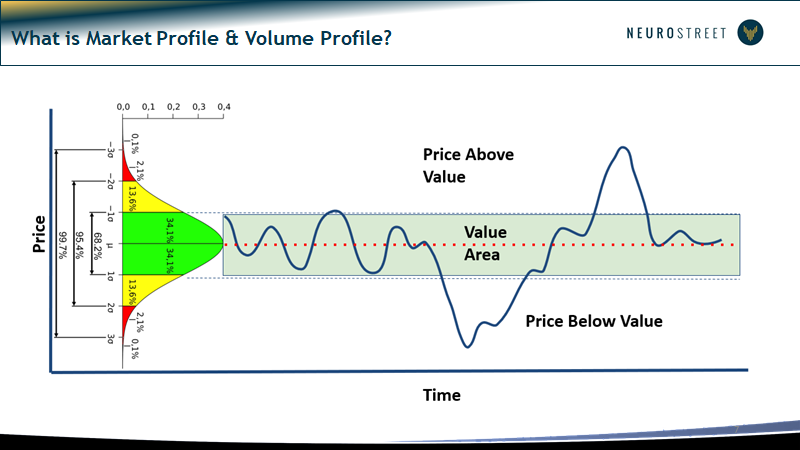

What is Volume Profile?

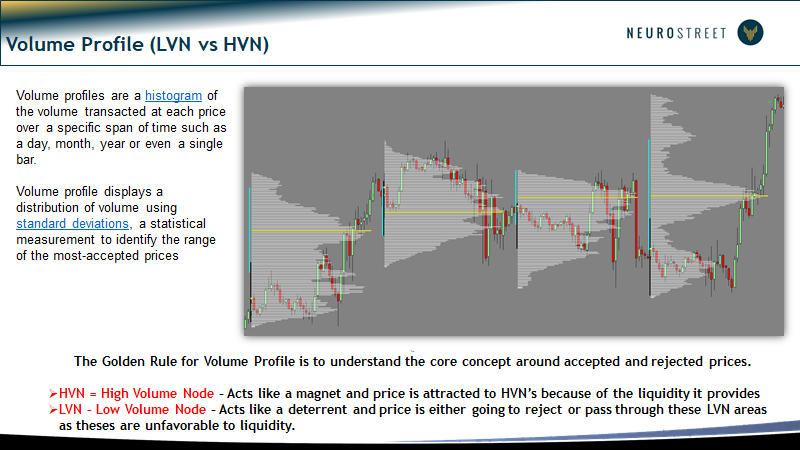

Volume profile is a trading tool that displays trading activity over a specified time period at certain price levels. Unlike traditional volume indicators that show volume at a point in time, volume profile provides a more in-depth view of the market.

Why Volume Profile Matters for Discretionary Traders

For discretionary traders, volume profile offers insights into market dynamics, helping to identify key support and resistance levels, value areas, and potential price movements.

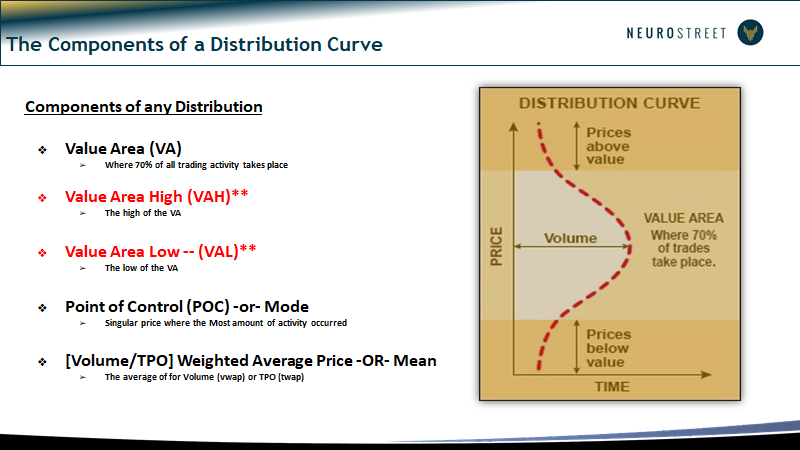

Key Concepts in Volume Profile

- Value Area:The range where a significant portion of trading activity occurs

- High Volume Nodes (HVN): Levels with high trading activity, often idicating strong support or resistance.

- Low Volume Nodes (LVN): Levels with low trading activity, potentially signaling price breakouts.

Basic Setup: Getting Started with Volume Profile

Setting up a volume profile involves selecting the right tools and understanding how to interpret the data.

Choosing the Right Trading Platform

Select a trading platform that offers robust volume profile tools. Platforms like Tickblaze are popular choices among discretionary traders.

Configuring Volume Profile Settings

- Time Frame Selection: Choose a time frame that aligns with your trading strategy.

- Volume Profile Types: Understand different types (e.g., session volume, composite volume) and their applications.

Practical Application: Using Volume Profile in Trading

Learn how to apply volume profile analysis in real trading scenarios to make informed decisions.

Identifying Trade Setups with Volume Profile

- Spotting High Probability Trades: Use HVNs and LVNs to identify potential entry and exit points.

- Combining with Other Indicators: Integrate volume profile with other technical indicators for a comprehensive analysis.

Common Mistakes to Avoid

Avoid common pitfalls when using volume profile, such as over-reliance on a single indicator or ignoring broader market trends.

Conclusion: Integrating Volume Profile into Your Trading Strategy

Incorporating volume profile into your discretionary trading can provide a deeper understanding of market dynamics, helping you make more informed trading decisions.

Further Learning and Resources

For those looking to deepen their knowledge, consider exploring advanced volume profile strategies and attending webinars or workshops.

DISCLAIMER

NeuroStreet (and all corporate and/or subsidiary brands) has no financial interest in the outcome of any trades mentioned herein. There is a substantial risk of loss when trading securities. You are solely responsible for all decisions regarding purchase or sale of securities (futures, forex, stocks, options, crypto), suitability, and your own risk tolerance. Choosing to engage in any of the products or services demonstrated presumes you have fully read and understood the risk involved in trading as set forth herein. There may be tax consequences for short-term profits or losses on trades. Consult your tax professional or advisor for details on these if applicable. Neither NeuroStreet (and all corporate and/or subsidiary brands), nor its principles, contractors or employees are licensed brokers or advisors.

NeuroStreet (and all corporate and/or subsidiary brands) offers services and products for educational purposes only. Market recommendations are not to be construed as investment or trading advice. You acknowledge that you enter into any transactions relying solely on your own judgment. Any market recommendations provided are generic only and may or may not be consistent with the market positions or intentions of NeuroStreet (and all corporate and/or subsidiary brands) or its affiliates. Any opinions, news, research, analysis, prices, or other information contained on our website or by presentation of our material is provided as general market commentary, and do not constitute advisory services.

All testimonials provided are the personal experiences of individual users and are not representative, nor do they constitute any guarantees or expectation of future performance. Results are not typical and have not been verified. All testimonials are to be considered for informational purposes only and should not be construed as investment or trading advice.

CFTC RULE 4.41 – Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

NOT INVESTMENT OR TRADING ADVICE | INFORMATIONAL AND EDUCATIONAL PURPOSES ONLY

Author Note:

This article was written by an independent communications consultant engaged by NeuroStreet. The author is not a licensed financial advisor or broker and does not provide trading, investment, or financial advice. All information has been prepared using materials provided by the client and is intended solely for educational and informational purposes.