Tickblaze has just raised the bar for what live market education should look like. In his first-ever livestreamed trading session, Tickblaze CEO Sean Kozak went live at the open—not as a commentator, but as a trader. Executing real trades across twenty $500,000 prop accounts, Sean walked viewers through live market structure, decision-making, and platform functionality in real time.

For the Tickblaze community, this wasn’t just another feature release. It was the debut of something far more powerful: direct access to how a seasoned professional reads and reacts to the market using Tickblaze’s full capabilities. And the best news? These livestreams will now become a regular event.

Let’s do a breakdown of what made the first session a must-watch masterclass—and what it means for the future of trading on Tickblaze.

A Real-Time Blueprint for Strategic Trading

From the first bell, Sean emphasized that trading isn’t about gambling on direction—it’s about mastering context and structure. Throughout the session, he taught how to:

- Read impulse moves and transitions

- Trade the first pattern after a trend shift

- Scale position size based on probability

- Use mental stops and avoid emotional overreaction

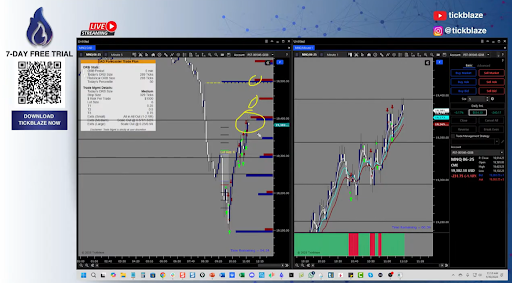

The stream became a live lab for what disciplined, high-performance trading looks like. With a $1,000 risk per trade across 20 prop accounts, Sean made decisions in real time with full transparency, giving the audience a front-row seat to elite-level execution.

Structure First, Setup Second

The session began with a trendline test—a moment that became a teachable case study. Price was trapped between two major strike levels, signaling caution. Sean reduced his size rather than forcing a trade and waited for clarity.

“If you’re in a low-probability zone, reduce your size or wait for confirmation.”

This principle guided the entire session: don’t trade noise, trade narrative. He avoided setups in “no man’s land” and waited for structure to present itself. This isn’t hindsight—it’s precision planning live on screen.

Trading the Transition, Not the Break

Most traders react to price. Sean trades before it moves. His edge lies in recognizing base candles forming on the right side of the 13 EMA and entering during the transition, not after.

“Most people are trading the zone. We trade the move as supply or demand is being created.”

He teaches traders to watch for a shift in momentum before the obvious breakout. This proactive approach, refined through years of experience, is what separates strategy from speculation.

Strike Prices as Institutional GPS

Tickblaze’s proprietary Striker tool was on full display. Sean used it to highlight where options strike prices and gamma flip zones dictate institutional intent.

- Price reversals happened exactly at strike prices.

- Market structure consistently respected these levels.

- Directional setups were planned around this data.

Instead of drawing arbitrary lines or waiting on indicators, Sean showed how to navigate markets using real institutional data. These aren’t just “levels”—they’re GPS markers for precision trading.

Discipline Over Drama

A pivotal moment came when Sean accidentally added to a position instead of scaling out. Rather than panicking, he managed the trade calmly, exited the position, and used it as a teaching opportunity:

“If you’re going to sit through drawdown, you better sit through discipline when the trade works.”

He drove home a powerful lesson: you don’t need perfection—you need composure. The market punishes emotional trading. Sean emphasized the importance of self-awareness, trade management, and sticking to the plan regardless of outcome.

Small Wins, Big Outcomes

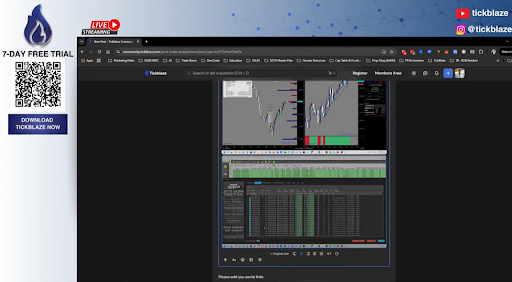

By session’s end, Sean posted $834 profit per account—$16,680 across 20 accounts after commissions.

But the goal wasn’t to impress with numbers—it was to show that consistent “base hits” add up. That’s the professional game. And in continuing past the morning session to teach more setups, Sean modeled how patience and timing can extract even more opportunity—when done right.

What’s Next for the Tickblaze Community

This session wasn’t a one-off. Sean announced ongoing livestreams, webinars, and platform education events. What’s available right now includes:

- Webinars covering One and Done and Opening Range Breakout (ORB) strategy

- Sessions on multi-timeframe trading and fractal structure for scalping and swing trading

- A vibrant community with strategy sharing, layout downloads, indicators, scripts, and leaderboard competitions

- Institutional-grade options data for all users

Final Takeaway: This Is What Real Trading Looks Like

What Kozak delivered wasn’t a flashy pitch or passive walkthrough—it was a blueprint for how serious traders should operate:

- Trade the first clean structure after a transition

- Let strike zones and real data guide your decision-making

- Manage size relative to probability

- Own your mistakes, adjust with logic, and keep going

Tickblaze was built for traders who want more than indicators and dashboards—it’s for those who want to learn the why behind the trade and execute with institutional insight.

With Sean now conducting live streams personally, Tickblaze traders are getting more than software—they’re getting leadership, mentorship, and the tools to evolve.

DISCLAIMER

NeuroStreet (and all corporate and/or subsidiary brands) has no financial interest in the outcome of any trades mentioned herein. There is a substantial risk of loss when trading securities. You are solely responsible for all decisions regarding purchase or sale of securities (futures, forex, stocks, options, crypto), suitability, and your own risk tolerance. Choosing to engage in any of the products or services demonstrated presumes you have fully read and understood the risk involved in trading as set forth herein. There may be tax consequences for short-term profits or losses on trades. Consult your tax professional or advisor for details on these if applicable. Neither NeuroStreet (and all corporate and/or subsidiary brands), nor its principles, contractors or employees are licensed brokers or advisors.

NeuroStreet (and all corporate and/or subsidiary brands) offers services and products for educational purposes only. Market recommendations are not to be construed as investment or trading advice. You acknowledge that you enter into any transactions relying solely on your own judgment. Any market recommendations provided are generic only and may or may not be consistent with the market positions or intentions of NeuroStreet (and all corporate and/or subsidiary brands) or its affiliates. Any opinions, news, research, analysis, prices, or other information contained on our website or by presentation of our material is provided as general market commentary, and do not constitute advisory services.

All testimonials provided are the personal experiences of individual users and are not representative, nor do they constitute any guarantees or expectation of future performance. Results are not typical and have not been verified. All testimonials are to be considered for informational purposes only and should not be construed as investment or trading advice.

CFTC RULE 4.41 – Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

NOT INVESTMENT OR TRADING ADVICE | INFORMATIONAL AND EDUCATIONAL PURPOSES ONLY

Author Note:

This article was written by an independent communications consultant engaged by NeuroStreet. The author is not a licensed financial advisor or broker and does not provide trading, investment, or financial advice. All information has been prepared using materials provided by the client and is intended solely for educational and informational purposes.