There’s a shift happening in retail prop trading—and Tickblaze is leading it.

For years, traders had to make compromises. Clunky software, limited broker connections, or clumsy workarounds were the norm. Not anymore. Tickblaze is redefining what it means to trade like a pro, whether you’re funded, getting evaluated, or scaling your strategies.

This guide connects Rithmic—a popular choice among futures traders and prop firms—to Tickblaze. More importantly, it’s a window into the broader infrastructure Tickblaze delivers for modern prop traders.

This setup is your launchpad if you’re trading with Rithmic, CQG, Interactive Brokers, or preparing for a prop challenge.

Why Use Rithmic with Tickblaze

Rithmic is one of the most trusted low-latency gateways for live market data and execution, especially in futures and prop trading. It’s a preferred connection for:

- Commodity markets

- Futures Commission Merchants (FCMs)

- Retail and institutional prop firms

Integrating Rithmic with Tickblaze gives you the institutional-grade infrastructure for routing orders, managing risk, and executing trades—without the usual limitations.

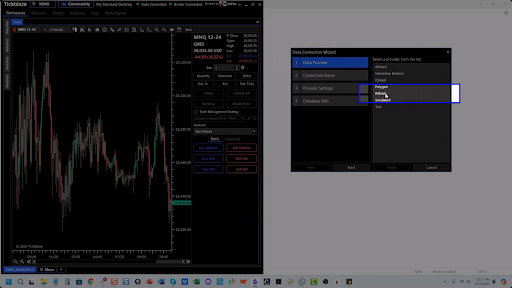

Image: Rithmic listed as Gateway, Clearing, and Risk provider

The Prop Trader’s Platform: Built for Performance

Tickblaze is not just a trading terminal—it’s a complete trading ecosystem built for today’s fast-moving prop trading world.

Whether you’re:

- Trading a funded futures account

- Running automated strategies

- Getting evaluated by firms like Apex, TopStep, or Prop Shop Trader

- Or building your own algorithmic edge from scratch

Tickblaze gives you the performance, flexibility, and support to do it at scale.

Why Prop Traders Are Switching:

- Plug-and-play algos for non-coders

- Advanced customization and scripting tools for quant-savvy traders

- Built-in backtesting and strategy optimization

- A marketplace full of free indicators and community-built resources

- Seamless connection with Rithmic, CQG, Interactive Brokers, and more

- A real trader community, not just a chatroom

This platform is designed to grow with you—from your first evaluation to your 100th funded trade.

Key Differences in Platform Design

Tickblaze uses a dual-connection architecture, which separates:

- Data Feed – for real-time price data

- Broker Connection – for account control and order execution

This gives traders more control, flexibility, and redundancy—key for anyone trading serious size or working across multiple accounts.

Image: Tickblaze wiki showing Data and Broker tabs

How to Connect Rithmic Data

To bring Rithmic market data into Tickblaze:

- Go to Connections → Add Data Connection

- Choose Rithmic

- Name your connection (e.g., “PST” for Prop Shop Trader)

- Enter your username and password

- Select the correct gateway (e.g., Chicago Aggregated)

- Choose the appropriate data mode:

- Aggregated or R Trader, depending on your firm

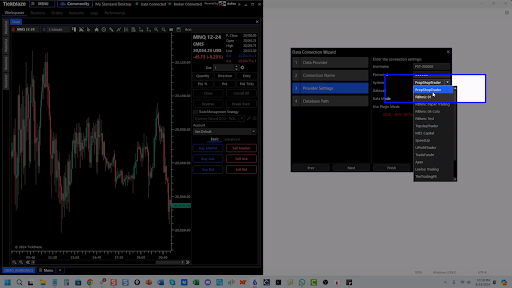

Image: Connection screen with Rithmic selected and PST label added

How to Connect Rithmic as a Broker

Once your data feed is live, link your brokerage account:

- Go to Connections → Add Broker Connection

- Select Rithmic

- Re-enter your credentials and gateway

- When authenticated, Tickblaze will populate your available accounts

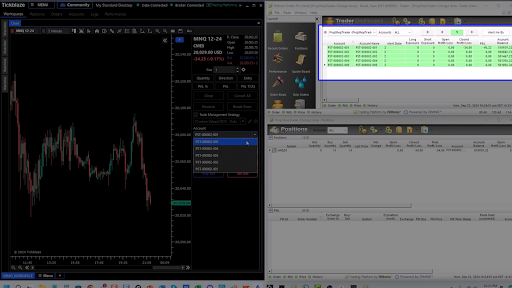

You’ll now have:

- Live market data

- A working account dropdown

- Active dashboards and trade tools

Image: Market data live in Trade Pad with a dropdown showing multiple accounts

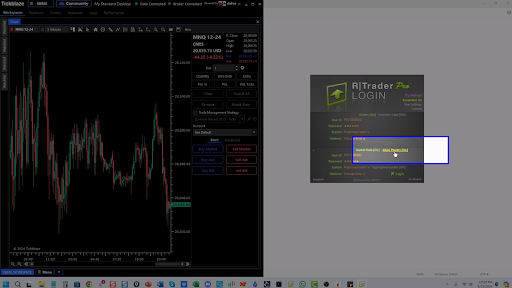

Using Plug-in Mode: When and Why

Most retail prop firms require plug-in mode with R Trader Pro running alongside Tickblaze.

Why It’s Critical:

- Ensures a redundant execution path

- Prevents trade discrepancies during high volatility

- Required for compatibility with firms like TopStep, Apex, and others

Setup Steps:

- In R Trader Pro, enable “Allow Plugins”

- In Tickblaze, check plug-in mode during the connection process

⚠️ Both platforms must match—plug-in mode must be either on in both or off in both.

Image: R Trader login screen with “Allow Plugins” checkbox

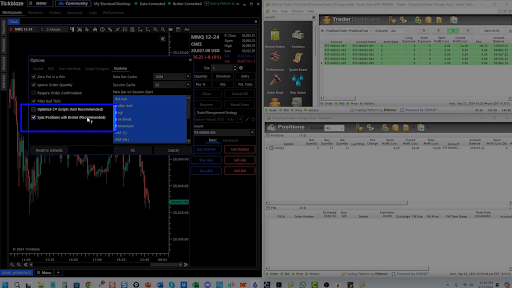

Enable Broker Sync: Managing Risk Across Platforms

To keep Tickblaze and R Trader in perfect sync, enable broker synchronization.

To Enable:

- Go to Tools → Options → Runtime

- Check “Sync Positions with Broker”

Why It Matters:

- Keeps your PnL and positions aligned

- It helps avoid ghost trades or reporting errors

- Allows you to close or manage trades from either platform

Image: Options window showing ‘Sync Positions with Broker’ checkbox

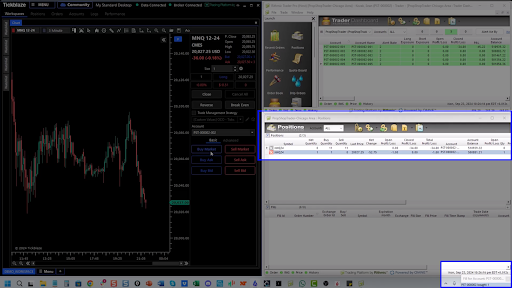

Real-World Example: Executing and Closing Trades

- Place a market order in Tickblaze

- Monitor the position in both:

- Tickblaze’s Positions tab

- R Trader Pro’s Account view

3. Close the position from either

4. With sync enabled, the change reflects instantly on both sides

Without sync, you’re left with an open position on one side, which can cost you.

Image: Market order execution with visual confirmation in Positions tab

Final Recommendations

✅ Must-Have Settings:

- Enable Plug-in Mode if required by your firm

- Turn on Broker Sync for reliable execution

💡 Pro Tips:

- Confirm whether your firm uses Aggregated or R Trader gateways

- Match plug-in mode settings exactly on both platforms

- Use clear naming for your connections

- Tap into Tickblaze’s wiki for tutorials and walkthroughs

💬 Need Help?

Tickblaze offers:

- Built-in documentation

- Email-based support

- Remote troubleshooting calls

Conclusion

Connecting to Rithmic through Tickblaze isn’t just a setup step—it’s a strategic decision. And it’s one more reason retail prop traders are making the switch.

Whether trading futures, forex, or multiple asset classes through a prop firm, Tickblaze gives you the tools, community, and performance you need to thrive. From built-in algos to advanced charting, dual connections to plug-in flexibility, Tickblaze isn’t just keeping up—it’s leading.

If you’re ready to trade like a pro, now’s the time to level up.

DISCLAIMER

NeuroStreet (and all corporate and/or subsidiary brands) has no financial interest in the outcome of any trades mentioned herein. There is a substantial risk of loss when trading securities. You are solely responsible for all decisions regarding purchase or sale of securities (futures, forex, stocks, options, crypto), suitability, and your own risk tolerance. Choosing to engage in any of the products or services demonstrated presumes you have fully read and understood the risk involved in trading as set forth herein. There may be tax consequences for short-term profits or losses on trades. Consult your tax professional or advisor for details on these if applicable. Neither NeuroStreet (and all corporate and/or subsidiary brands), nor its principles, contractors or employees are licensed brokers or advisors.

NeuroStreet (and all corporate and/or subsidiary brands) offers services and products for educational purposes only. Market recommendations are not to be construed as investment or trading advice. You acknowledge that you enter into any transactions relying solely on your own judgment. Any market recommendations provided are generic only and may or may not be consistent with the market positions or intentions of NeuroStreet (and all corporate and/or subsidiary brands) or its affiliates. Any opinions, news, research, analysis, prices, or other information contained on our website or by presentation of our material is provided as general market commentary, and do not constitute advisory services.

All testimonials provided are the personal experiences of individual users and are not representative, nor do they constitute any guarantees or expectation of future performance. Results are not typical and have not been verified. All testimonials are to be considered for informational purposes only and should not be construed as investment or trading advice.

CFTC RULE 4.41 – Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

NOT INVESTMENT OR TRADING ADVICE | INFORMATIONAL AND EDUCATIONAL PURPOSES ONLY

Author Note:

This article was written by an independent communications consultant engaged by NeuroStreet. The author is not a licensed financial advisor or broker and does not provide trading, investment, or financial advice. All information has been prepared using materials provided by the client and is intended solely for educational and informational purposes.