You’ve got Tickblaze—now it’s time to make it work for you. This isn’t about convincing you it’s the best; you’re already here. This guide is your fast track to hitting the ground running: from installation to custom setups, broker links, and beyond. Whether you’re scalping futures or fine-tuning algos, we’re cutting through the noise to get you trading smarter, faster. Let’s dive in.

In this guide, we’ll walk through:

- Installing Tickblaze and understanding its key components

- Setting up your custom trading desktop

- Connecting to market data and broker accounts

- Navigating the platform’s default features

- Taking advantage of advanced functionalities and future tutorials

Let’s get started.

1. Installation and Initial Setup

Download and Installation

After downloading Tickblaze from the official website, you’ll notice two icons on your computer:

Tickblaze CLI – A command-line interface primarily for developers creating or modifying programmed trading strategies.

Tickblaze Desktop – The main application for discretionary and automated trading.

Always begin with Tickblaze Desktop to access all essential trading functionalities.

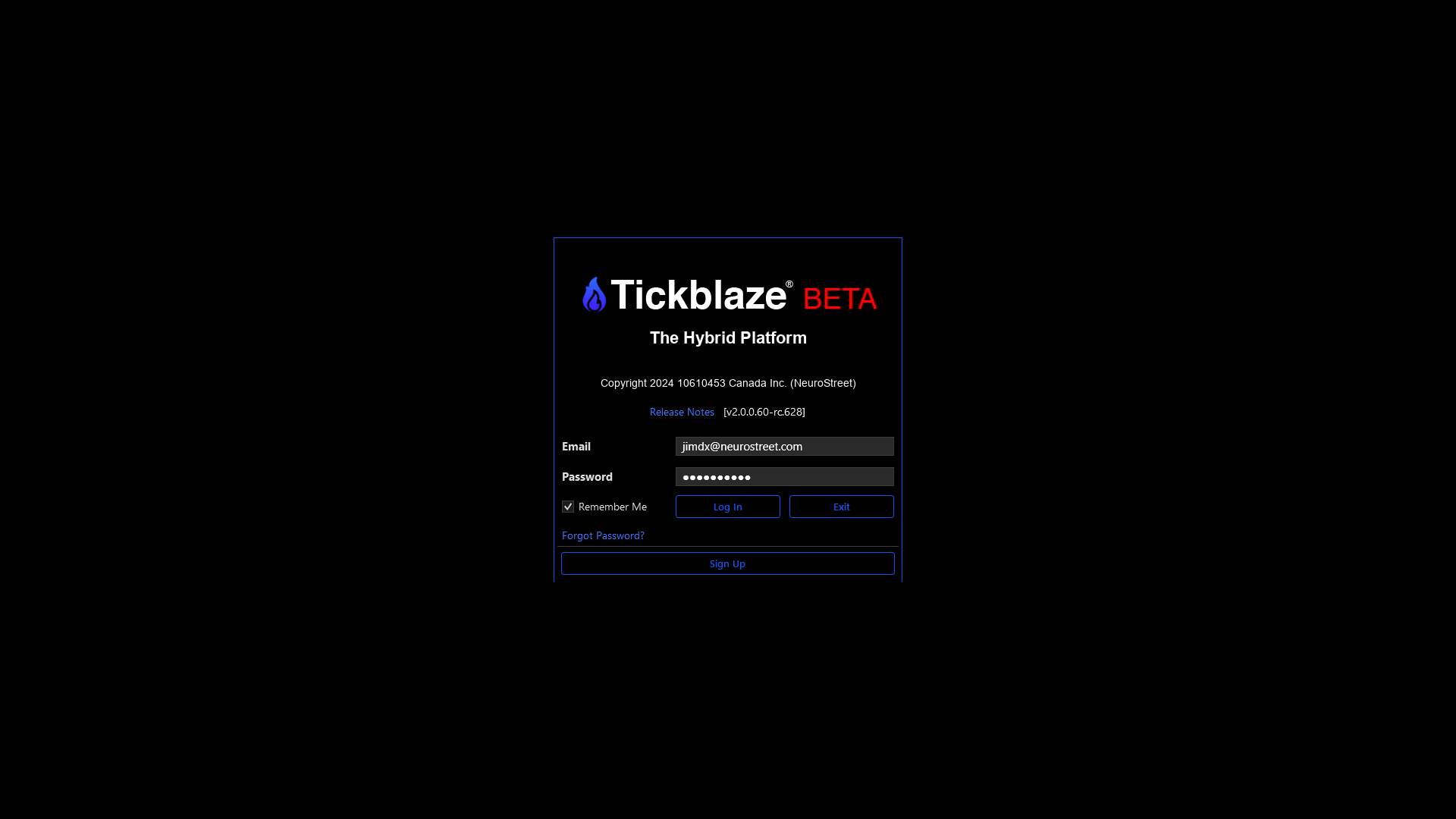

Logging In

When you launch Tickblaze Desktop, you’ll be prompted to enter your credentials, which are sent to you via email after requesting the free trial.

- Check the “Remember Me” option to streamline future logins.

- If you encounter any login issues, contact Tickblaze support for immediate assistance.

Showing the Tickblaze login window with username, password fields, and a “Remember Me” checkbox.

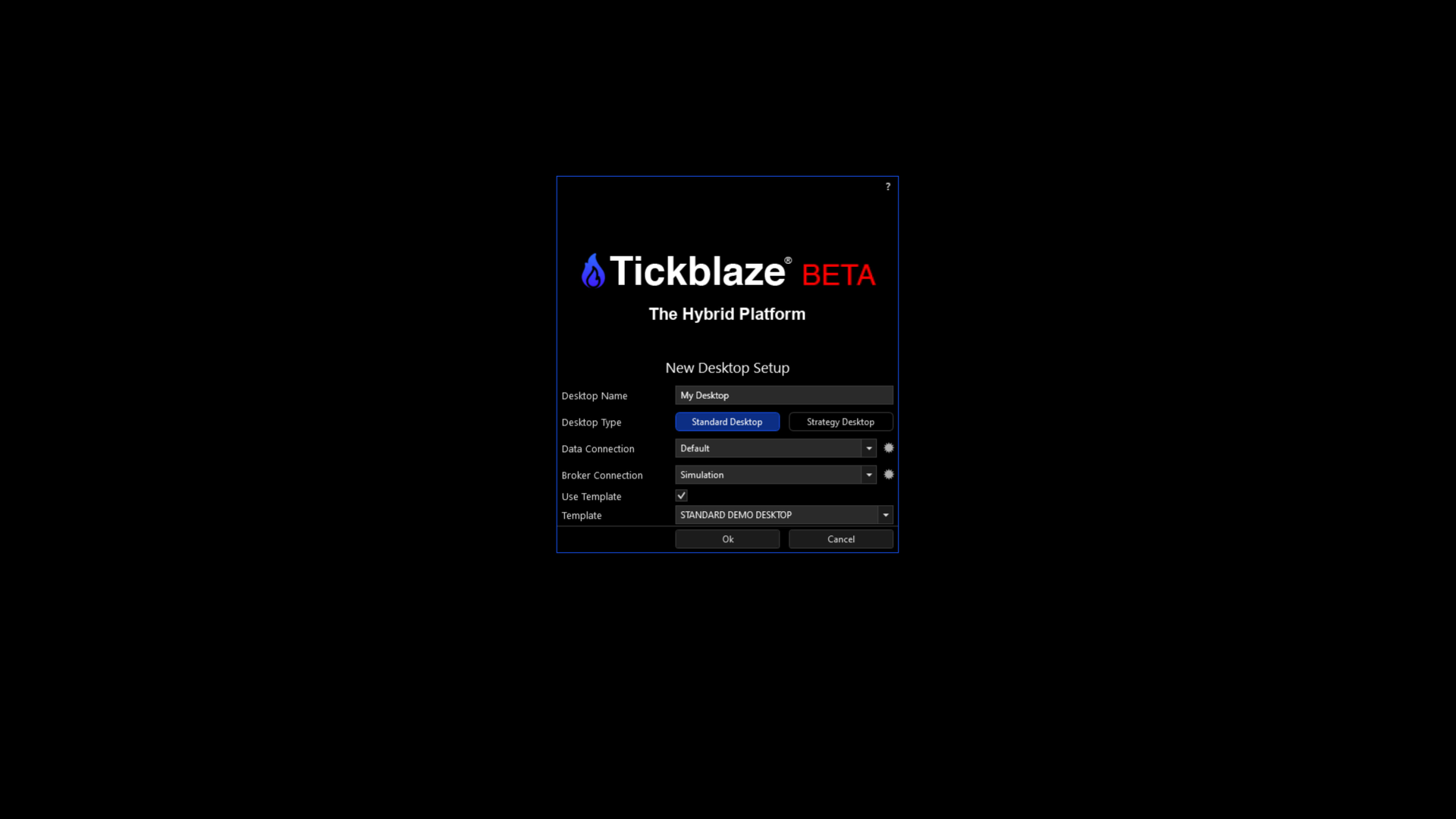

2. Setting Up Your Desktop

Upon your first login, Tickblaze will prompt you to configure a trading desktop—think of this as your personal command center where you organize charts, watchlists, and trading tools.

Naming and Choosing a Desktop Type

- Standard Desktop – Perfect for general trading, chart analysis, and watchlist monitoring.

- Strategy Desktop – Designed for traders who focus on running, testing, and deploying strategies.

Most traders will start with the Standard Desktop. A pre-built template is available to make setup quick and intuitive.

3. Customizing Connections

Adding Live Broker Accounts

When you’re ready for live trading, connect your preferred brokerage account to Tickblaze:

- Rithmic – Favored by futures traders for its speed and reliability.

- Interactive Brokers – Ideal for multi-asset traders (stocks, options, futures, forex).

- Other Partners – Tickblaze continues to expand its supported broker list.

How to Add a Broker Connection

- Go to Menu > Connections > Broker Connection.

- Choose your preferred broker from the list.

- Enter your broker credentials.

- Confirm the connection, and you’re set.

Showing the broker connection window with Rithmic, Interactive Brokers, and other supported broker options.

4. Platform Navigation and Next Steps

Default Workspace Features

After the initial setup, you’ll see a default workspace loaded with:

- Pre-Populated Watchlists – Keep track of your favorite symbols or popular market movers.

- Fully Customizable Charts – Resize, reorganize, and apply indicators as needed.

- Strategy-Friendly Layout – For those who want to integrate and test automated strategies.

Showing the main Tickblaze interface with watchlists on one side and charts on the other.

Future Tutorials and Enhancements

Tickblaze is continually evolving, and upcoming guides will dive into:

- Building & Saving Multiple Desktops – Tailor each workspace to your trading style.

- Running Backtests & Strategy Simulations – Validate trading ideas with historical data.

- Optimizing Execution Speed – Ensure your orders reach the market as quickly as possible.

5. Key Takeaways

- Simple Installation Download Tickblaze, install, and access its trading environment via the Desktop icon.

- Pre-Configured Market Data No extra subscription fees for real-time data. Contracts roll over automatically, saving you time and money.

- Flexible Broker Integration Add popular brokers like Rithmic and Interactive Brokers. Start with a built-in simulation account to test strategies.

- Customizable Workspaces Quickly set up a Standard or Strategy Desktop, or build your own layout for maximum efficiency.

- Support for All Trader Types Whether you’re a discretionary day trader or a strategist, Tickblaze has features to suit your needs.

6. Getting Help and Moving Forward

If you need any assistance along the way, Tickblaze support is just a click away. From login troubleshooting to advanced strategy consultation, the support team is ready to help.

Ready to elevate your trading experience?

- Download Tickblaze if you haven’t already, and explore its intuitive yet powerful interface.

- Follow our upcoming tutorials for deeper insights into building desktops, customizing charts, and automating strategies.

Final Thoughts

Tickblaze combines the essential elements of modern trading—real-time data, seamless broker connections, and an adaptable user interface—without the hidden costs and complexities often found in other platforms. Whether you’re practicing in simulation mode or deploying a high-frequency strategy, Tickblaze stands ready to help you make the most of every market opportunity.

DISCLAIMER

NeuroStreet (and all corporate and/or subsidiary brands) has no financial interest in the outcome of any trades mentioned herein. There is a substantial risk of loss when trading securities. You are solely responsible for all decisions regarding purchase or sale of securities (futures, forex, stocks, options, crypto), suitability, and your own risk tolerance. Choosing to engage in any of the products or services demonstrated presumes you have fully read and understood the risk involved in trading as set forth herein. There may be tax consequences for short-term profits or losses on trades. Consult your tax professional or advisor for details on these if applicable. Neither NeuroStreet (and all corporate and/or subsidiary brands), nor its principles, contractors or employees are licensed brokers or advisors.

NeuroStreet (and all corporate and/or subsidiary brands) offers services and products for educational purposes only. Market recommendations are not to be construed as investment or trading advice. You acknowledge that you enter into any transactions relying solely on your own judgment. Any market recommendations provided are generic only and may or may not be consistent with the market positions or intentions of NeuroStreet (and all corporate and/or subsidiary brands) or its affiliates. Any opinions, news, research, analysis, prices, or other information contained on our website or by presentation of our material is provided as general market commentary, and do not constitute advisory services.

All testimonials provided are the personal experiences of individual users and are not representative, nor do they constitute any guarantees or expectation of future performance. Results are not typical and have not been verified. All testimonials are to be considered for informational purposes only and should not be construed as investment or trading advice.

CFTC RULE 4.41 – Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

NOT INVESTMENT OR TRADING ADVICE | INFORMATIONAL AND EDUCATIONAL PURPOSES ONLY

Author Note:

This article was written by an independent communications consultant engaged by NeuroStreet. The author is not a licensed financial advisor or broker and does not provide trading, investment, or financial advice. All information has been prepared using materials provided by the client and is intended solely for educational and informational purposes.