Understanding and Implementing VWAP in Your Trading Strategy

Volume Weighted Average Price (VWAP) is a critical tool for traders. This guide will walk you through the key concepts of VWAP and how to set it up effectively on your trading platform.

What is VWAP?

VWAP stands for Volume Weighted Average Price, a trading benchmark that provides the average price a security has traded at throughout the day, based on both volume and price.

The Importance of VWAP in Trading

VWAP is used by traders to gauge the market trend and ensure trades are executed near the market average.

Key Concepts in VWAP Analysis

- Price Trend Indicator: VWAP can indicate bullish or bearish trends.

- Benchmark for Trade Execution: Helps in determining whether a security is overvalued or undervalued.

Setting Up VWAP on Trading Platforms: A Step-by-Step Guide

Different trading platforms have their own ways of setting up VWAP. Here’s a general guide that applies to most platforms.

Step 1: Selecting Your Trading Platform

Step 2: Accessing VWAP Indicator

Step 3: Configuring VWAP Settings

Step 4: Applying VWAP to Your Chart

Practical Application: Using VWAP in Trading Decisions

Learn how to use VWAP to make informed trading decisions, such as identifying entry and exit points and managing risk.

Trading Strategies Involving VWAP

- Identifying Market Trends: Use VWAP to understand market direction.

- Optimizing Entry and Exit Points: Trade around VWAP for optimal price execution.

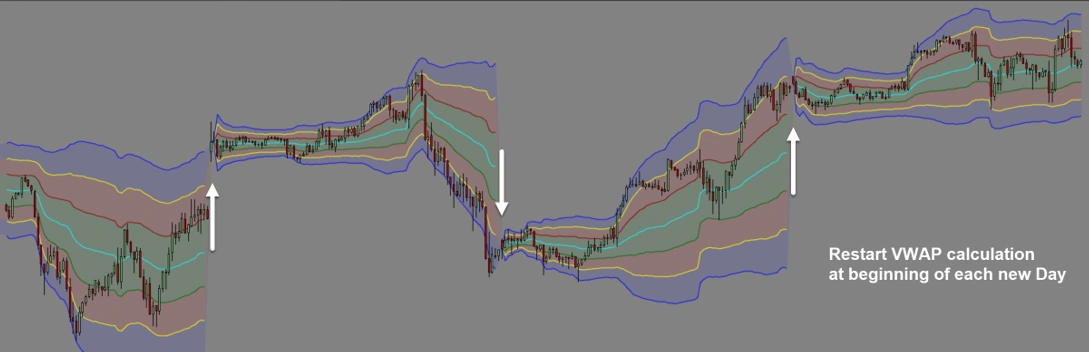

Daily VWAP

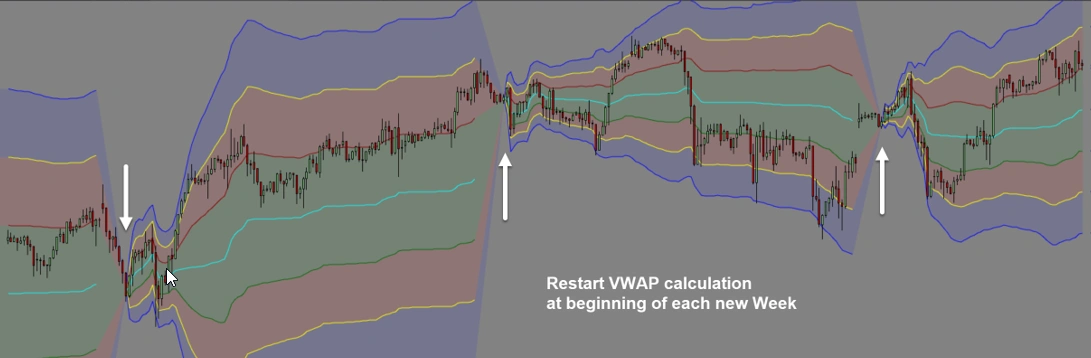

Weekly VWAP

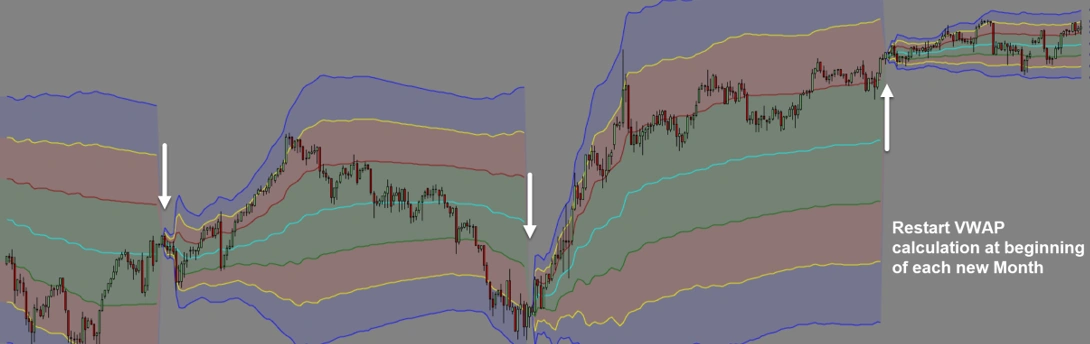

Monthly VWAP

Common Mistakes to Avoid with VWAP

Avoid pitfalls such as relying solely on VWAP without considering other market factors or misinterpreting its signals.

Conclusion: Enhancing Your Trading with VWAP

Incorporating VWAP into your trading toolkit can provide valuable insights into market trends and help in executing trades at favorable prices.

Further Learning and Advanced Techniques

For those looking to deepen their VWAP knowledge, consider exploring advanced strategies and attending specialized trading seminars or webinars.