The Tickblaze Marketplace has officially opened, and it’s not just a feature drop—it’s a strategic pivot. Built exclusively for the Tickblaze trading platform, this marketplace is a dedicated ecosystem for proprietary tools, indicators, and systems that push beyond what’s available on legacy platforms.

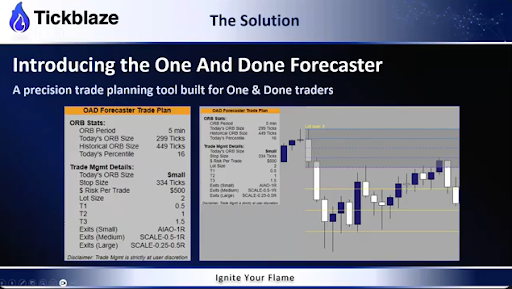

Key Highlight: The One and Done Forecaster

The first app released is a heavy hitter. The One and Done Forecaster is a trade planning powerhouse designed for one thing: making market open trading faster, smarter, and statistically sound. And it does so without executing trades—keeping full control in the trader’s hands.

What the One and Done Forecaster Does

Real-Time Trade Planning, No Guesswork

The moment the opening candle closes, the tool analyzes the Opening Range Bar (ORB) and compares it to over 100 past sessions, categorizing it as small, medium, or large. This instantly informs the strategy: quick in-and-out, scaled targets, or stand down entirely.

Statistical Trade Logic

It auto-plots statistically likely targets (0.25R, 0.5R, 1:1) and dynamically updates them bar by bar—no more arbitrary R multiples. You’re not planning trades based on hope—you’re planning based on math.

Entry Precision With Offset Lines

Avoid false breakouts by setting offset entries within or just outside the ORB. This feature is beneficial on assets like gold, where optimal entries occur slightly deeper into the range.

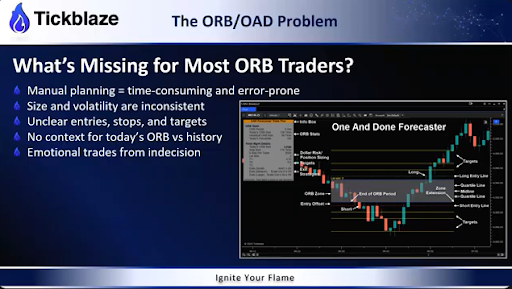

Solving Real Problems Traders Face Every Morning

Market Opens Are Fast—and Costly

Traders often miss the best setups because they can’t analyze and plan fast enough. The Forecaster handles entry zones, contract sizing, risk/reward setups, and exits—all in seconds.

Universal Application

Whether you’re in futures, equities, or forex, the Forecaster adapts to the structured open behavior of the market in question. It’s already used across trading rooms like Ethan’s equities sessions and Jeff’s futures room.

Deep Dive: Strategy Engine Under the Hood

Quartile-Based Targeting

Three quartile lines (Q1, Q2, Q3) are plotted based on ORB size, providing precision exit and stop zones instead of guessing at the opposite end of the bar.

Customizable Lookback Periods

Traders can choose how much historical data to compare (e.g., 5, 30, or 100 days), tailoring the tool to short-term bias or long-term patterns.

Real-Time Market Matching

Each market is different. What works on the NASDAQ may fail on crude oil. The software adjusts accordingly—automatically.

Installation and Access: Streamlined and Secure

- Create a Tickblaze Account – Required to access the marketplace.

- Use Your Promo Code – First-time buyers get 50% off plus a full year of maintenance included.

- Download and Import – Installation takes minutes: Tools > Import Resources > upload ZIP.

- Auto-License Integration – Licenses are tied to your Tickblaze user ID for seamless operation.

Marketplace vs. Platform: The New Model

Platform = Engine

Tickblaze is the core—your command center for trading.

Marketplace = Extensions

Apps like the One and Done Forecaster are the smart extensions that enhance your performance.

Think of the platform as the smartphone and the marketplace as the app store—except every app is built for pros, not games.

Final Word: This Is the Future of Smart Trading

The One and Done Forecaster isn’t a gimmick. It’s not a repackaged indicator. It’s the product of years of statistical study, user feedback, and the urgent need to fix one of trading’s biggest problems: managing trades at the open.

If you want precision without paralysis, clarity without chaos, and a real edge based on actual data—this is it.

DISCLAIMER

NeuroStreet (and all corporate and/or subsidiary brands) has no financial interest in the outcome of any trades mentioned herein. There is a substantial risk of loss when trading securities. You are solely responsible for all decisions regarding purchase or sale of securities (futures, forex, stocks, options, crypto), suitability, and your own risk tolerance. Choosing to engage in any of the products or services demonstrated presumes you have fully read and understood the risk involved in trading as set forth herein. There may be tax consequences for short-term profits or losses on trades. Consult your tax professional or advisor for details on these if applicable. Neither NeuroStreet (and all corporate and/or subsidiary brands), nor its principles, contractors or employees are licensed brokers or advisors.

NeuroStreet (and all corporate and/or subsidiary brands) offers services and products for educational purposes only. Market recommendations are not to be construed as investment or trading advice. You acknowledge that you enter into any transactions relying solely on your own judgment. Any market recommendations provided are generic only and may or may not be consistent with the market positions or intentions of NeuroStreet (and all corporate and/or subsidiary brands) or its affiliates. Any opinions, news, research, analysis, prices, or other information contained on our website or by presentation of our material is provided as general market commentary, and do not constitute advisory services.

All testimonials provided are the personal experiences of individual users and are not representative, nor do they constitute any guarantees or expectation of future performance. Results are not typical and have not been verified. All testimonials are to be considered for informational purposes only and should not be construed as investment or trading advice.

CFTC RULE 4.41 – Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

NOT INVESTMENT OR TRADING ADVICE | INFORMATIONAL AND EDUCATIONAL PURPOSES ONLY

Author Note:

This article was written by an independent communications consultant engaged by NeuroStreet. The author is not a licensed financial advisor or broker and does not provide trading, investment, or financial advice. All information has been prepared using materials provided by the client and is intended solely for educational and informational purposes.