Algorithmic trading isn’t just for institutions anymore. With Tickblaze, anyone can design, optimize, and trade professional-grade strategies. But to extract consistent edge, you need more than tools — you need the right workflow.

In this post, we’re breaking down a complete end-to-end strategy process for Tickblaze users: from concept and testing, to deployment and weekly optimization.

🔗 Want the full deep-dive? Access the complete guide now in our official Tickblaze Wiki

Step 1: Start with Built-In Strategies

Your algo trading journey starts with Tickblaze’s Strategy Desktop:

- Create a new desktop with no templates applied.

- Connect to real-time data from providers like Databento, Rithmic, or IQFeed.

- Use the Strategy Wizard to select a built-in strategy and configure your timeframes, symbols, and parameters.

This gives you a clean foundation for testing before graduating to more advanced strategy types.

Step 2: Upgrade to Algo Engine Strategies

When you’re ready to go deeper, Algo Engine Strategies give you modular control over your trades.

These are composed of:

- Signal Generator – your unique entry logic (e.g. Close Flip Algo)

- Core Engine – standardized execution, money management, and filtering components

With these, you unlock:

- Dynamic profit target splitting

- Directional overrides via toolbar

- Circuit breakers like DayMaxLoss, High Water Mark %

- Filters based on time, trend, and momentum

Step 3: Use Staged Optimization (Don’t Overfit!)

Don’t optimize everything at once. Break your optimization into 3 clear stages:

✅ Stage 1: Validate the Signal

- Disable filters

- Use loose stops and small targets

- Goal: Find Profit Factor > 1.0 and positive expectancy

✅ Stage 2: Optimize the Trade Plan

- Lock in the signal settings

- Test and optimize exit logic (stops, targets, offsets)

✅ Stage 3: Add Filters One at a Time

- Time of day

- Moving average filters

- Momentum indicators

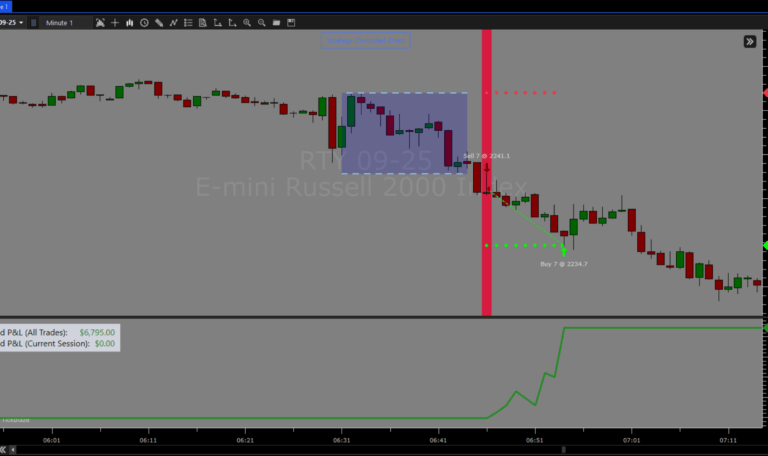

🧠 Pro Tip: Use Tickblaze charts to visually narrow down parameter ranges before running full optimizations.

Step 4: Choose the Right Optimization Method

You have two options:

- Brute Force – Exhaustive but slow. Best for <4 parameters.

- Genetic Algorithm (GA) – Smart, fast, ideal for large parameter sets.

Use GA when:

- You’re optimizing >5 parameters

- You want speed and strong solutions

Set your GA intelligently:

- 50–200 generations

- Population size: 100–200

- Optimize for: Profit Factor or Expectancy, not raw Net Profit

Step 5: Validate, Validate, Validate

A great backtest doesn’t mean a great strategy. Prove your edge with these tests:

- Out-of-Sample (OOS) Testing – use 20–30% of recent data

- Walk-Forward Analysis (WFA) – re-optimize every month

- Use realistic costs – commissions and slippage matter

- Watch all the metrics – not just profit. Track:

- Max Drawdown

- Expectancy

- Sharpe Ratio

- Profit Factor

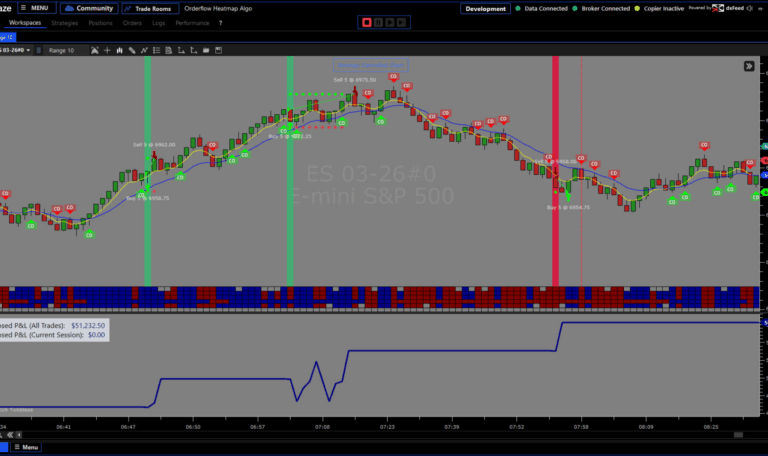

Step 6: Go Live — Safely

To deploy your strategy:

- Set your Desktop Mode to Live Trading

- Load your optimized parameters

- Activate your strategy and disable others

- Monitor real-time performance tabs

- Use the live toolbar for manual directional control

⚠️ Always configure your Money Management settings before going live.

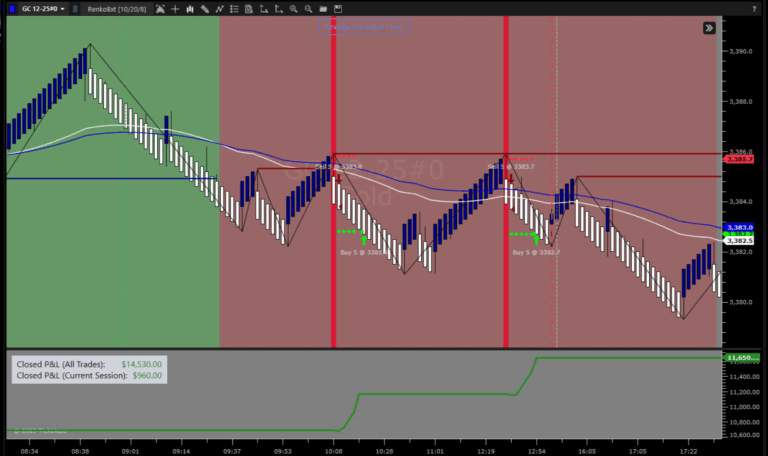

Step 7: Weekly Re-Optimization = Long-Term Edge

Markets change. Re-optimizing keeps your strategy aligned.

Use this 3-step weekly cycle:

- Optimize using this past week’s data

- Validate using the week before

- Only deploy if results remain consistent

This loop helps you adapt while staying grounded in real performance data.

Bonus: Let AI Be Your Research Assistant

AI tools like ChatGPT can help:

- Analyze CSVs from backtests

- Suggest indicator ranges

- Interpret tradeoffs across filters

But be specific. Always provide platform, algo name, and your settings context.

Final Word: Professional Workflow, Proven Tools

With Tickblaze and this structured approach, you’re not just building algos — you’re building a trading system that evolves with the market.

📘 Grab the full PDF strategy guide now in our official Tickblaze Wiki

It covers everything: from genetic algorithm tips to deployment setups and risk guardrails. Bookmark it. Share it. Trade smarter.