In trading, any price consolidation is followed by a breakout that reverses or continues the preceding trend. A trader’s goal then becomes how to accurately identify consolidation patterns and the direction of the subsequent breakouts. While there are several chart patterns, wedge patterns are versatile because they are easy to identify and allow traders to determine if the trend will continue or reverse.

Wedge patterns can be continuation or reversal chart patterns depending on their structure and the preceding trend. We’ll break down how wedge patterns form, how to identify them correctly, and how you can use them to trade bullish or bearish continuations and reversals.

What is a Wedge Chart Pattern?

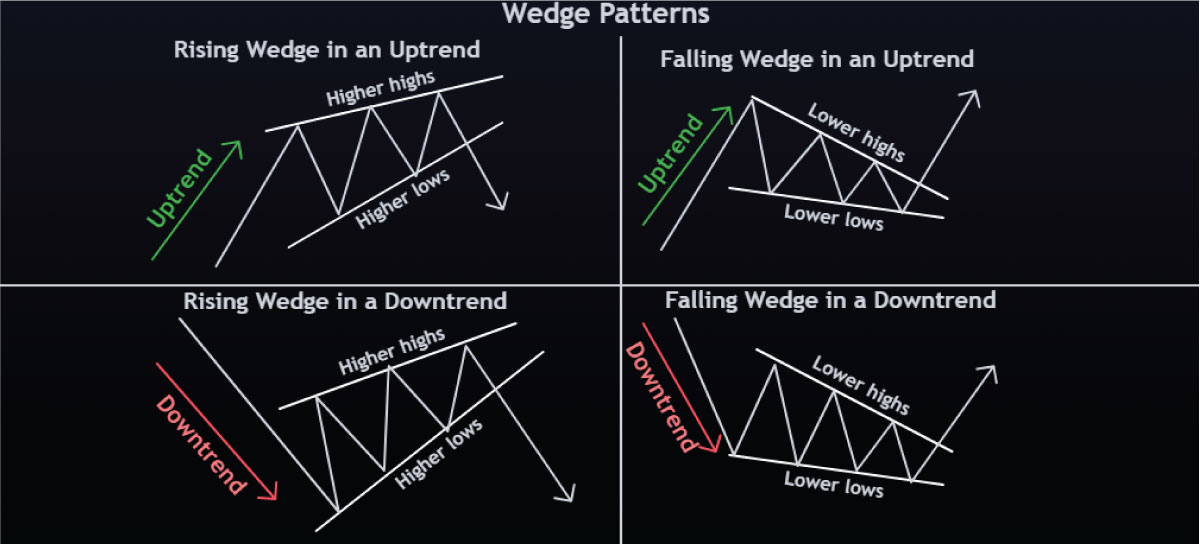

Both rising and falling wedge chart patterns form as a result of two converging trendlines connecting successive highs and lows. This pattern’s characteristic ‘wedge’ shape forms because the highs and lows during the consolidation phase rise or fall at different rates. That means, depending on their direction, a wedge can either be a rising or falling wedge chart pattern.

The upper trendline is the pattern’s resistance, and the lower trendline is the support. When these trendlines converge, they resemble an asymmetrical triangle pattern.

What is a Rising Wedge Pattern?

Rising wedge chart patterns are bearish chart patterns. They form when the price action consolidates within two ascending trendlines converging towards each other. That means the asset forms higher highs and higher lows.

Note that the higher lows are rising faster than the higher highs, meaning that the lower trendline (the support) is steeper than the upper trendline (the resistance). That shows the bullish momentum is weakening, and a break below the support level is imminent.

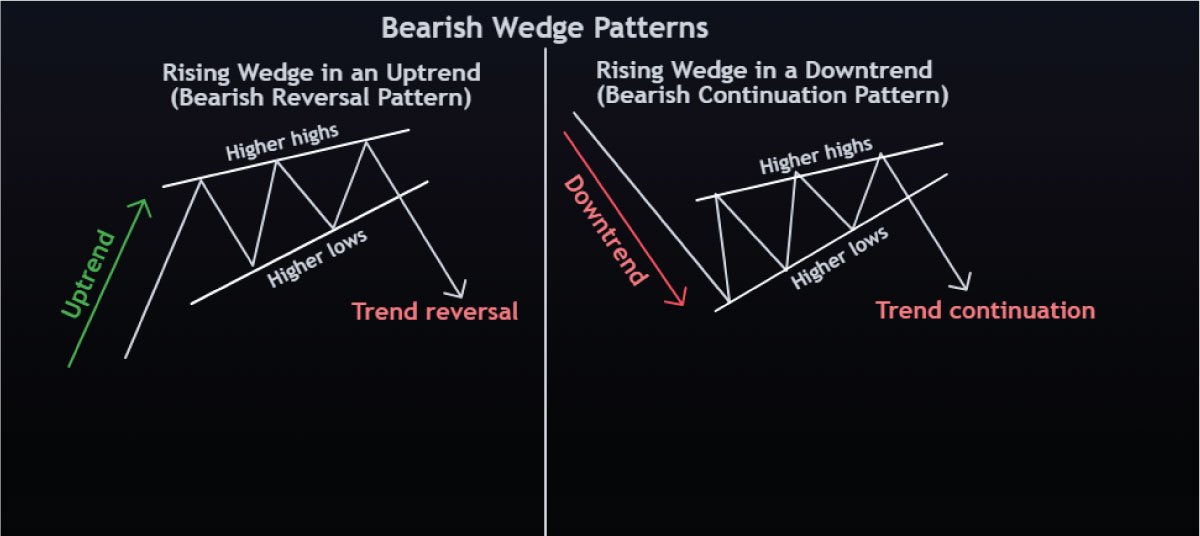

Rising wedge patterns could be bearish reversal or continuation patterns depending on where they appear on a trend.

If a rising wedge chart pattern appears in an uptrend, it signals a potential trend reversal – it’s a bearish reversal chart pattern. On the other hand, if a rising wedge chart pattern forms after a bearish trend, it signals a possible trend continuation after the consolidation period.

How to Trade Rising Wedge Pattern

Since a rising wedge is a bearish chart pattern, you can execute short positions after a confirmed breakout below the lower trendline.

If you want to trade the rising wedge pattern, make sure that the price action meets these conditions before you short the market:

- There must be a preceding bullish or bearish trend.

- A subsequent consolidation period with higher highs and higher lows forms a rising wedge. The higher lows must rise faster than the higher highs – a sign of weakening bullish momentum.

- A decline in the volume traded as the wedge chart pattern forms.

- A breakout below the lower trendline (the support). An increase in the volume must accompany this breakout.

Note that the stop loss should be at the most recent swing high, just above the upper trendline. You can set the target price to equal the height of the wedge at its widest point.

Rising Wedge Pattern in an Uptrend – Bearish Reversal Pattern

When it forms during an uptrend, a rising wedge signals a possible bearish reversal. It usually forms towards the end of an uptrend and signals a potential bullish to bearish reversal. Once it forms, you can exit your long positions and look for a setup to short the market.

The ideal entry for a short position would be after a confirmed breakout below the support level. That means waiting for the breakout candle to close below the lower trendline.

Rising Wedge Pattern in a Downtrend – Bearish Continuation Pattern

In a downtrend, a rising wedge is a bearish continuation chart pattern. It forms during a momentary pause in a bearish trend before the trend continues. The ideal entry for a short position would be after a confirmed break below the lower trendline.

What is a Falling Wedge Pattern?

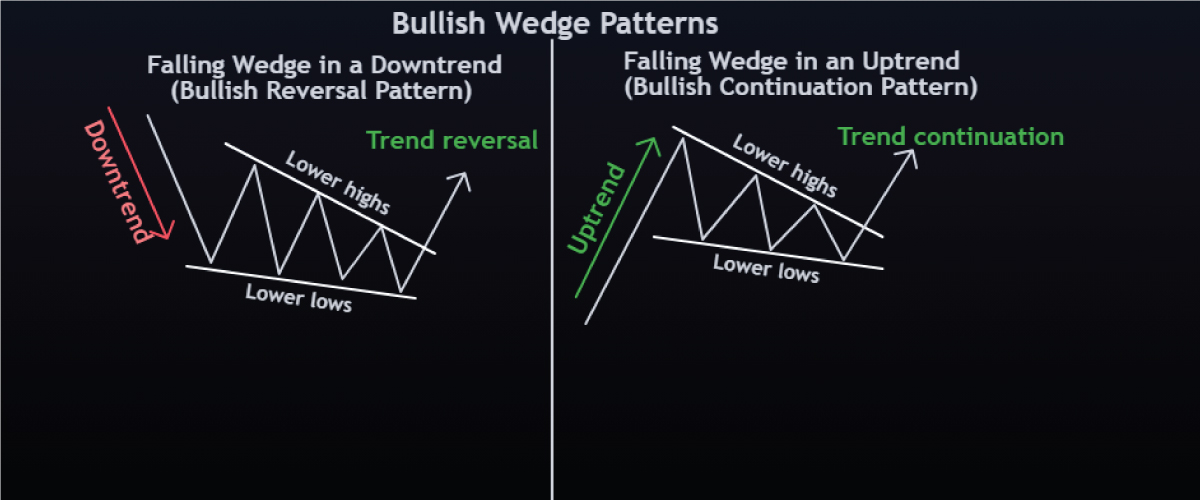

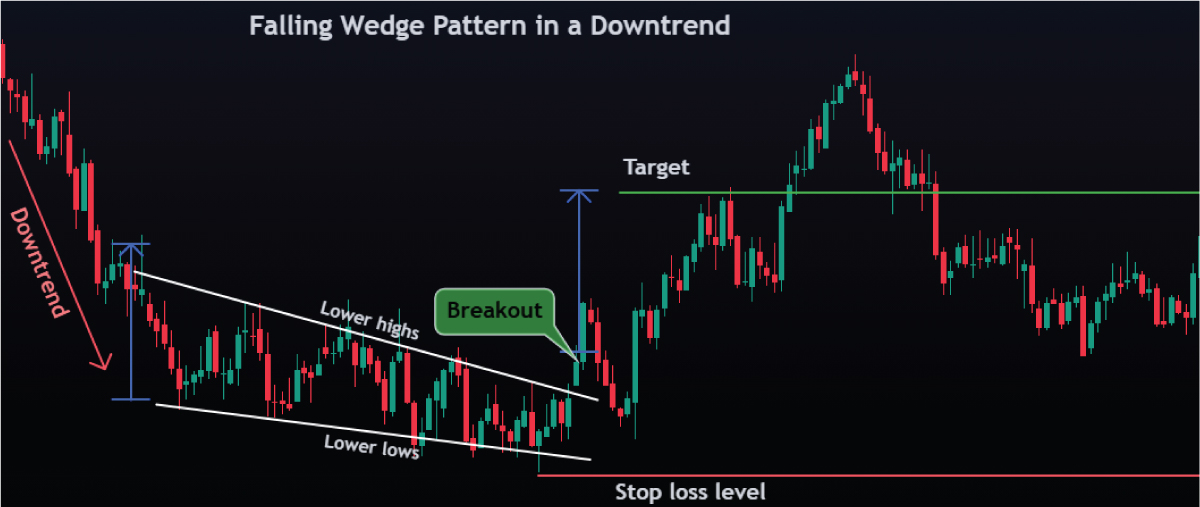

Falling wedge chart patterns are bullish chart patterns, and they can be either bullish reversal or continuation chart patterns depending on the preceding trend. They form when the price action consolidates within two descending trendlines converging towards each other. That means the asset forms lower highs and lower lows.

As the pattern forms, the highs drop faster than the lows, resulting in a steeper upper trendline (resistance) compared to the lower trendline (support). This structure shows that although the price is dropping, the bearish momentum is weakening, and there’s an impending break above the resistance.

If a falling wedge chart pattern forms in a downtrend, it’s a bullish reversal pattern signaling a potential change from a bearish to a bullish trend. However, if a falling wedge appears in an uptrend, it signals a possible bullish trend continuation after the consolidation period.

How to Trade the Falling Wedge Patterns

Falling wedges are bullish chart patterns, which means you can execute long positions after a confirmed breakout above the upper trendline.

If you want to trade the falling wedge pattern, make sure that all these conditions are met before you open a long position:

- A prior bullish or bearish trend.

- A consolidation period with the price action forming lower highs and lower lows. The highs drop faster than the lows, resulting in a steeper upper trendline (resistance) compared to the lower trendline (support). This shows that the selling momentum is weakening.

- A decline in the volume traded as the falling wedge chart pattern forms.

- A breakout above the upper trendline (the resistance). An increase in the volume must accompany this breakout.

When trading the falling wedge chart pattern, the stop loss should be at the most recent swing low, just below the lower trendline. You can set the target price to equal the height of the wedge at its widest point.

Falling Wedge Pattern in a Downtrend – Bullish Reversal Pattern

In a downtrend, a falling wedge is a bullish reversal chart pattern. It usually forms towards the end of a downtrend and signals a potential bearish to bullish reversal. Once it forms, you can exit your long positions and look for opportunities to go long.

The ideal entry for a long position would be after a confirmed breakout above the upper trendline. That means waiting for the breakout candle to close above the resistance level.

Falling Wedge Pattern in an Uptrend – Bullish Continuation Pattern

A falling wedge in an uptrend is a bullish continuation chart pattern. It forms during a momentary pause in a bullish trend before the trend continues.

The Bottom Line

Whether the preceding trend will reverse or continue entirely depends on the type of wedge pattern. Here’s a quick summary of the four wedge patterns:

- Bearish reversal if it’s a rising wedge pattern in an uptrend.

- Bearish continuation if it’s a rising wedge pattern in a downtrend.

- Bullish reversal if it’s a falling wedge pattern in a downtrend.

- Bullish continuation if it’s a falling wedge pattern in an uptrend.

Wedge chart patterns signal a pause in the current trend and should get your attention.