Introduction to Volume Profile for Discretionary Traders

Understanding the volume profile is crucial for discretionary traders seeking to analyze market structure and price movements more effectively. This guide will introduce you to the fundamental concepts of volume profile trading and how it can be integrated into your trading strategy.

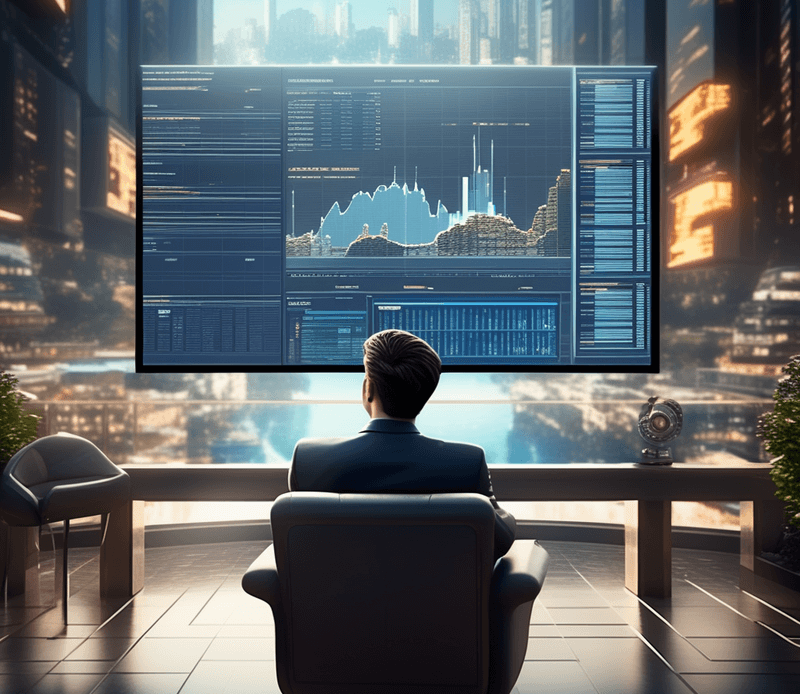

What is Volume Profile?

Volume profile is a trading tool that displays trading activity over a specified time period at certain price levels. Unlike traditional volume indicators that show volume at a point in time, volume profile provides a more in-depth view of the market.

Why Volume Profile Matters for Discretionary Traders

For discretionary traders, volume profile offers insights into market dynamics, helping to identify key support and resistance levels, value areas, and potential price movements.

Key Concepts in Volume Profile

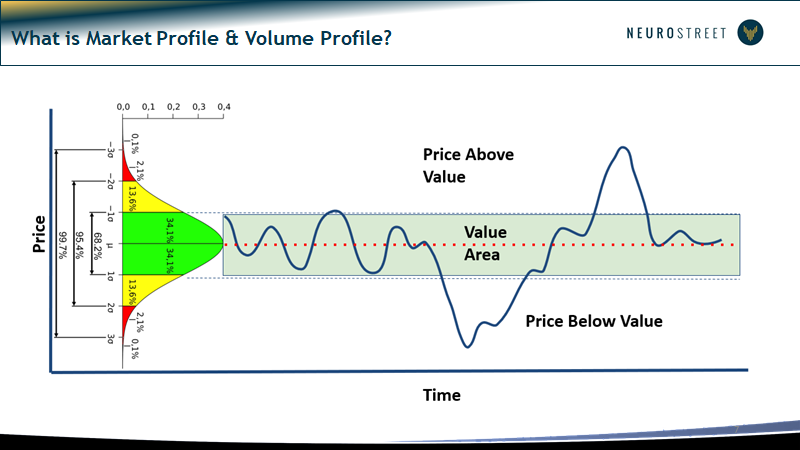

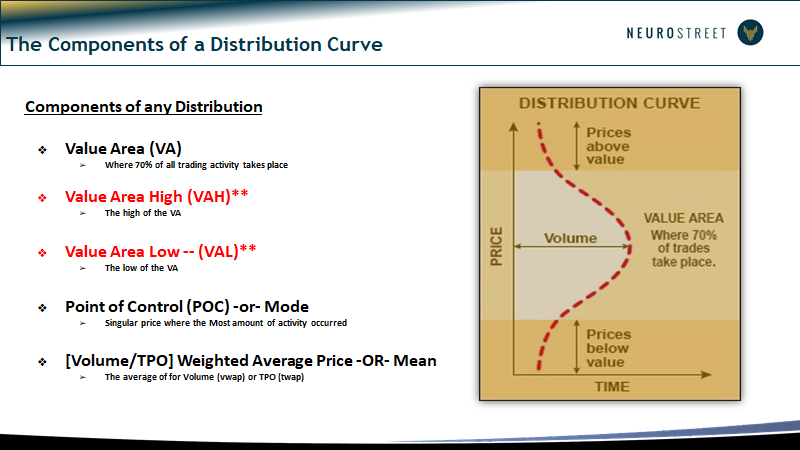

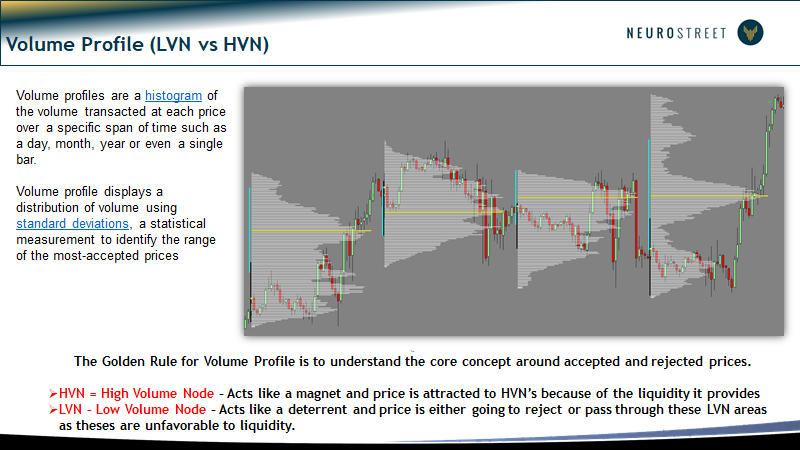

- Value Area:The range where a significant portion of trading activity occurs

- High Volume Nodes (HVN): Levels with high trading activity, often idicating strong support or resistance.

- Low Volume Nodes (LVN): Levels with low trading activity, potentially signaling price breakouts.

Basic Setup: Getting Started with Volume Profile

Setting up a volume profile involves selecting the right tools and understanding how to interpret the data.

Choosing the Right Trading Platform

Select a trading platform that offers robust volume profile tools. Platforms like Tickblaze are popular choices among discretionary traders.

Configuring Volume Profile Settings

- Time Frame Selection: Choose a time frame that aligns with your trading strategy.

- Volume Profile Types: Understand different types (e.g., session volume, composite volume) and their applications.

Practical Application: Using Volume Profile in Trading

Learn how to apply volume profile analysis in real trading scenarios to make informed decisions.

Identifying Trade Setups with Volume Profile

- Spotting High Probability Trades: Use HVNs and LVNs to identify potential entry and exit points.

- Combining with Other Indicators: Integrate volume profile with other technical indicators for a comprehensive analysis.

Common Mistakes to Avoid

Avoid common pitfalls when using volume profile, such as over-reliance on a single indicator or ignoring broader market trends.

Conclusion: Integrating Volume Profile into Your Trading Strategy

Incorporating volume profile into your discretionary trading can provide a deeper understanding of market dynamics, helping you make more informed trading decisions.

Further Learning and Resources

For those looking to deepen their knowledge, consider exploring advanced volume profile strategies and attending webinars or workshops.