Quant Desktop

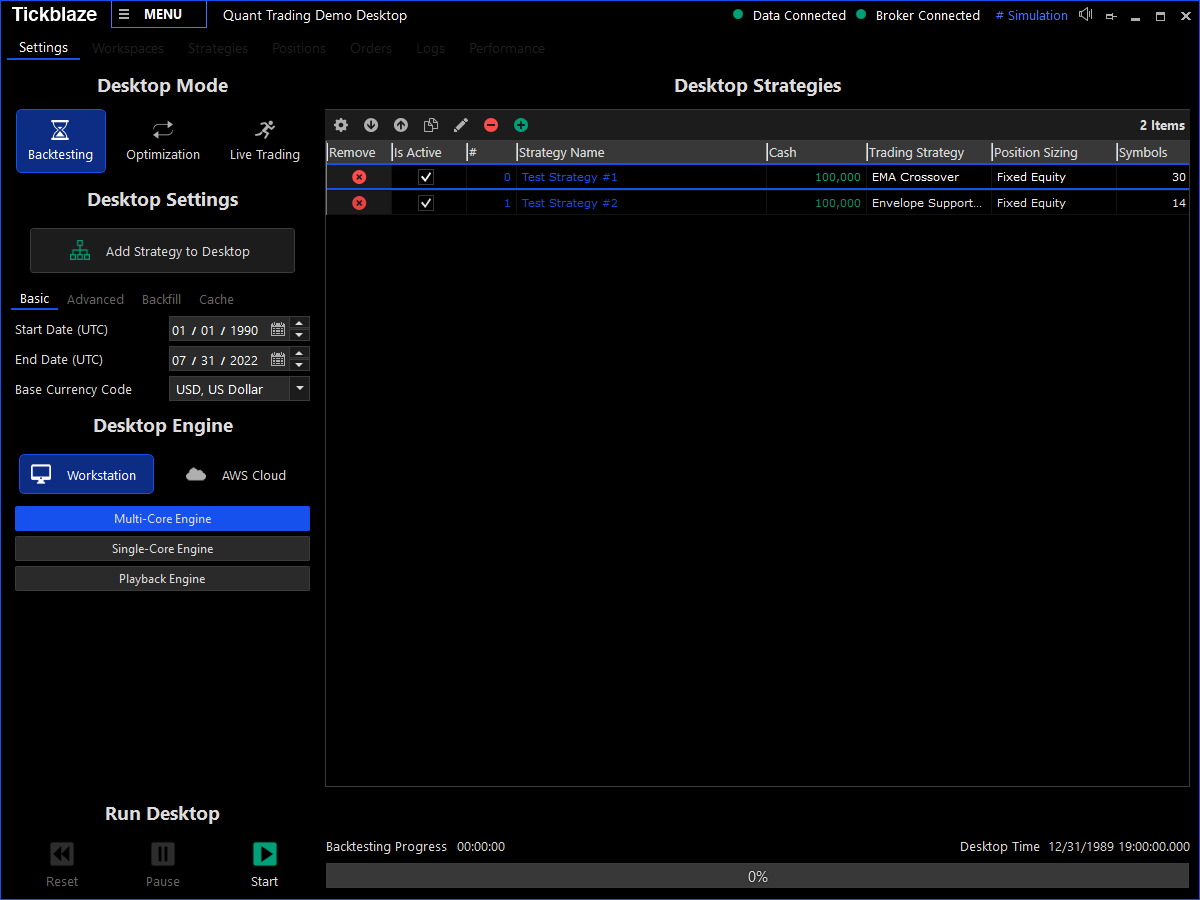

The Tickblaze platform was designed to have a single highly optimized engine that is capable of backtesting, optimizing, simulating and trading an entire portfolio of strategies. A single Quant Desktop can host one or more strategies such that each strategy can trade multiple symbols from multiple asset classes in multiple time zones and using multiple bar types, all in one integrated environment.

Quant Desktop Settings

The Quant Desktop settings are organized into the following sections:

Quant Desktop Tabs

The Quant Desktop has the following tabs:

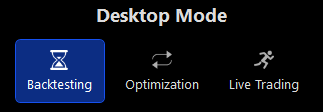

A Quant Desktop can run in multiple modes:

|

Image |

Description |

|

|

Backtesting - Backtests the Quant Desktop and all of its strategies from a specified start date to a specified end date. |

|

Playback - Backtests the Quant Desktop in slow motion while visualizing and animating the entire process, including the order tables, position tables, charts and performance results. |

|

|

Optimization - Repeatedly backtests the Quant Desktop while modifying the parameter values accepted by some of its scripts. The results of each backtest are later displayed in the Optimization Results Window. |

|

|

Simulation - Runs the Quant Desktop with streaming real time market data while it's connected to the Simulation / Paper Trading brokerage connection. This will utilize the backtesting engine to test the strategies with real time market data without risking any capital. |

|

|

Live Trading - Runs the Quant Desktop with streaming real time market data while it's connected to a real brokerage connection (even if it's a broker provider's paper trading account). |

Basic Settings

|

Image |

Description |

|

|

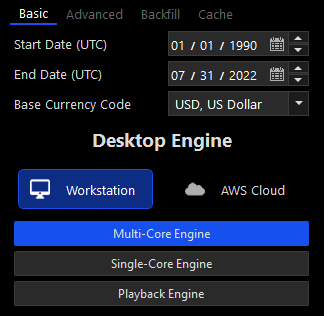

Start Date (UTC) - The start date from which to backtest or optimize the desktop strategies. |

|

End Date (UTC) - The end date up to which to backtest or optimize the desktop strategies. |

|

|

Base Currency Code - The base currency code for the Desktop and all of its strategies. |

|

|

Multi-Core / My Computer - The Desktop will be backtested or optimized at full speed using all of the CPU cores with up to 100% utilization. |

|

|

Single-Core / My Computer - The Desktop will be backtested or optimized using only one of the CPU cores, allowing the computer to run other software. |

|

|

Playback / My Computer - The Desktop will be backtested slowly while updating order tables, position tables, charts and workspaces. |

Advanced Settings

|

Image |

Description |

|

|

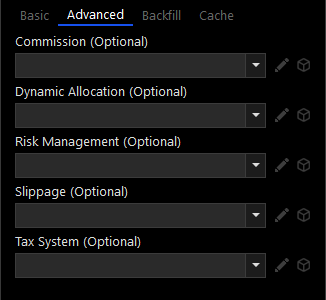

Commission Script - The commission script is used for calculating the commission paid to a broker for each executed order, based on the broker's exact commission schedule. |

|

Dynamic Allocation Script - The dynamic allocation script is used for systematically redistributing cash between Desktop strategies based on their performance or some other heuristic. |

|

|

Risk Management - The risk management script is used for managing risk by modifying or cancelling trading strategy orders based on portfolio level risk analysis. |

|

|

Slippage - The slippage script is used for simulating market slippage, by adjusting the order fills execution price so that they include slippage. |

|

|

Tax System - The tax system scripts are used for calculating and reducing the capital gain taxes created by the strategies. |

Backfill Settings

|

Image |

Description |

|

|

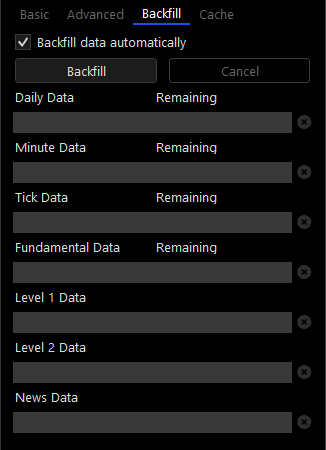

Backfill data automatically - Indicates whether historical market data should be downloaded automatically from the data provider every time the Desktop is run. The platform will attempt to detect whether market data is actually missing before requesting it from the data provider. You should disable this when backtesting the Desktop repeatedly on the same data. |

|

Backfill - Starts importing any missing historical market data required for running the Quant Desktop. |

|

|

Cancel - Cancels the backfill process. |

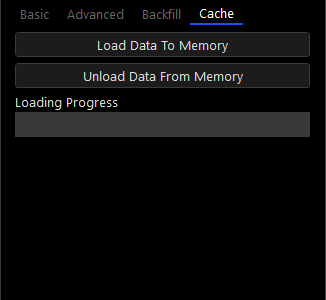

Cache Settings

|

Image |

Description |

|

|

Load Data To Memory - Load all of the Desktop's historical market data into memory so that repeated backtests and optimizations run faster. Note that before loading the data you need to make sure your machine has enough RAM for all of it. |

|

Unload Data From Memory - Unload the cached data for the Desktop. |

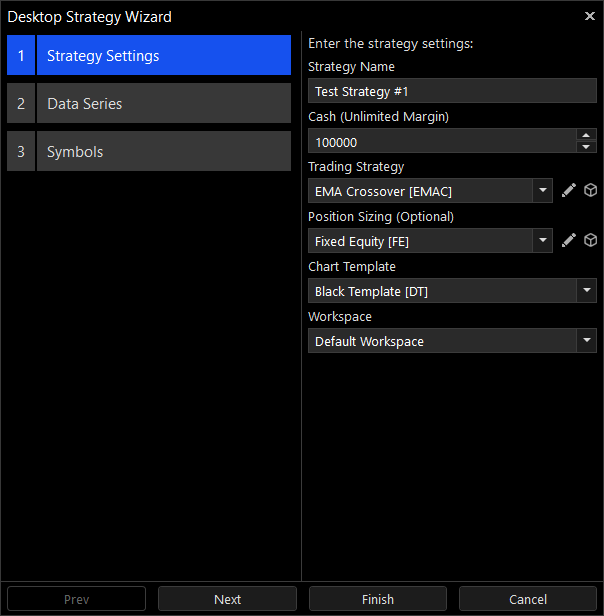

The Quant Desktop can be set up with one or more strategies using the Desktop Strategy Wizard. To open the wizard simply click the 'Add Strategy to Desktop' button in the Desktop Settings area.

Strategy Settings

|

Image |

Description |

|

|

Strategy Name -The strategy name identifies it in various displays throughout the desktop. |

|

Cash (Unlimited Margin) - The initial amount of cash the trading strategy can trade. Note that all strategies have an unlimited no interest margin loan, which means that orders are not cancelled due to lack of funds. This figure is mostly used for various performance calculations. |

|

|

Trading Strategy -The trading strategy script that does the trading. Trading strategy scripts are used for trading one symbol at a time such that each symbol gets its own strategy instance. |

|

|

Position Sizing (Optional) - The position sizing script is used for overriding the quantity of pending orders after those were generated by the trading strategy. This script is optional since orders are assigned a quantity by the trading strategy that generated them. |

|

|

Chart Template - The template used as the default chart template for all of the strategy charts. Each symbol assigned to the strategy will automatically be created a chart using this chart template. |

|

|

Workspace - The default workspace used for this strategy in the Workspaces tab. Each strategy is automatically created a workspace in the desktop's workspaces tab. |

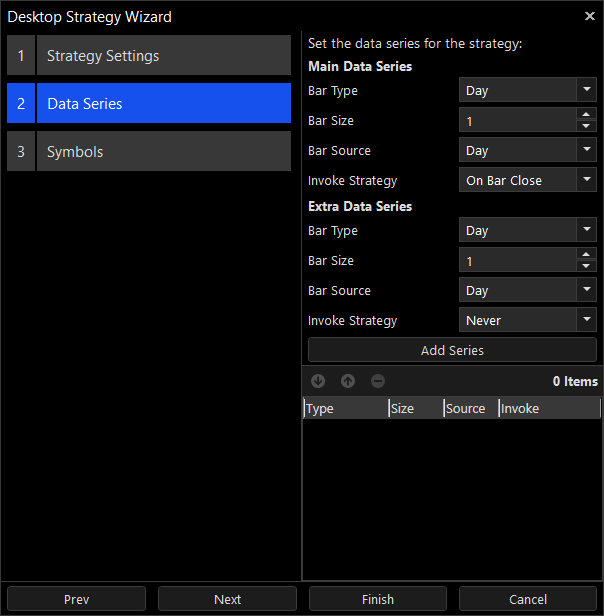

Data Series

|

Image |

Description |

|

|

Main Data Series -The main data series is used for all of the strategy calculations, including order execution, backtesting and performance results. |

|

Extra Data Series - The extra data series can be used as an additional data series to the trading strategy. A single strategy can have an unlimited number of extra data series assigned to it. |

|

|

Bar Type - The bar type or bar internval used by the strategy data series. |

|

|

Bar Size - The bar size, which is measured in the relevant units for the bar type. Time periods for seconds and minutes, shares/contracts for volume, and ticks/pips for most others. |

|

|

Bar Source - The bar source used for building the bars in the data series. |

|

|

Invoke Strategy - Indicates whether the strategy will be invoked on bar close, on bar update or never. Invoking the strategy on bar close means that its OnBarUpdate function will only be called after a data bar is fully constructued. Invoking the strategy on bar update means that its OnBarUpdate function will be called every time the data bar is updated with the underlying data coming from its bar source. Never invoking the strategy means that OnBarUpdate is never called for this bar type. |

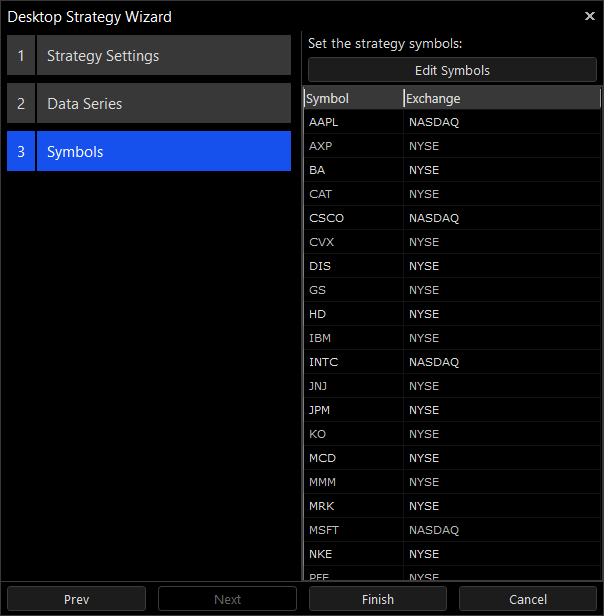

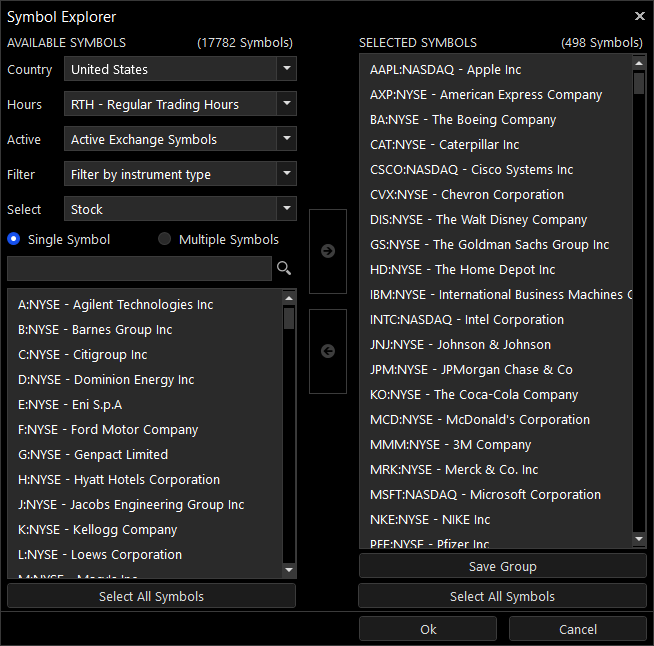

Symbols

|

Image |

Description |

|

|

Edit Symbols - Opens the Symbol Explorer window which is used for selecting the strategy's symbols. |

|

Available Symbols -The list of symbols from which to select the strategy symbols. |

|

|

Selected Symbols - The symbols selected and assigned to the strategy. |

|

|

Country - A filter that excludes all of the symbols that do not belong to an exchange / venue in the select country. |

|

|

|

Hours - A filter that excludes all of the symbols that do not belong to the selected trading hours schedule. |

|

Active - A filter that excludes either the active symbols or non-active symbols in the exchange. |

|

|

Filter - Select an additional filter with which to filter the available symbols. |

The Quant Desktop can be started, paused and reset.

|

Description |

|

Start - Starts the Quant Desktop using its current setup. |

|

Pause - Pauses the Quant Desktop while maintaining its transactions log. |

|

Reset - Resets the Quant Desktop by deleting its transactions log. |

|

Desktop Progress - Displays the backtesting or optimization progress in percentage points. |