As a trader monitoring a live price action, it may take work to know which direction the market will take. Will the current trend continue? Will it reverse? This is where the knowledge of candlestick patterns comes in.

We’ll break down what continuation candlestick patterns are, how you can identify the popular bullish and bearish continuation candlestick chart patterns, and how to trade them.

Trend Continuation Candlestick Pattern Explained

Continuation candlestick patterns occur mid-trend (bullish or bearish), indicating that the prevailing dominant trend will likely continue after a temporary pause. You can use these patterns to jump in on a trend once the momentum picks up.

Continuation candlestick patterns can be single, double, or triple, depending on the number of core candlesticks in the pattern. Note that continuation candlestick patterns can be as bullish or bearish trend continuation candlestick chart patterns, depending on where they form in a trend.

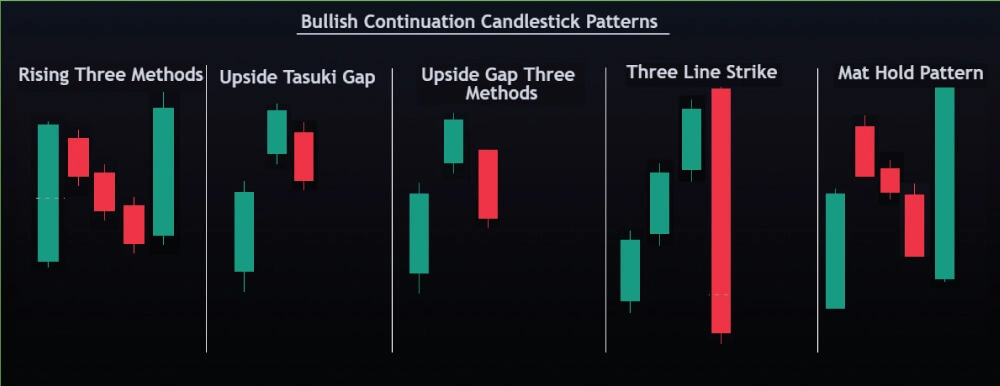

Bullish Continuation Candlestick Patterns

Bullish candlestick patterns usually form during an uptrend, representing a temporary pause before an eventual breakout to continue the bullish trend. When these patterns appear on a chart, there’s a high probability that the observed bullish trend will continue.

Some of the top bullish trend continuation candlestick patterns include the rising three methods, Mat hold pattern, Upside Tasuki gap, three line strike, and upside gap three methods candlestick patterns.

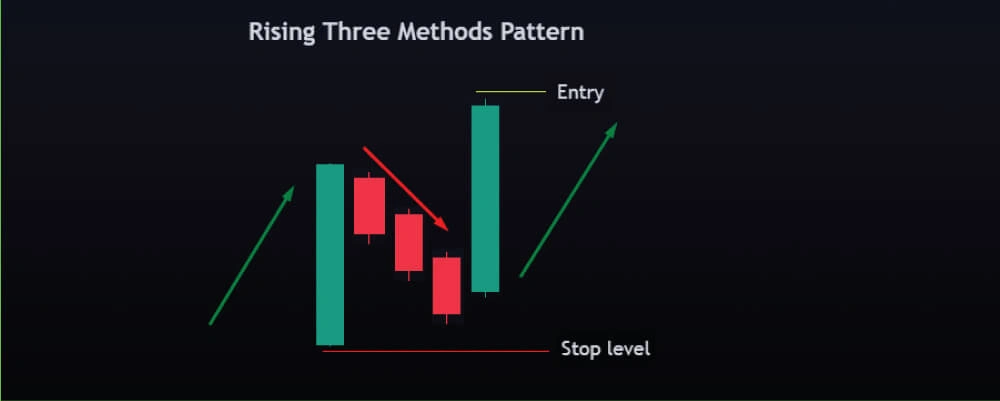

1. Rising Three Methods Candlestick Pattern

The rising three methods is a bullish trend continuation candlestick pattern. An ideal rising three methods candlestick pattern consists of at least five candlesticks and usually occurs in an uptrend. Three small bearish candles are sandwiched between two large-bodied bullish candlesticks.

The first candle in the pattern is a large bullish candle followed by three smaller bearish candles, all contained within the first bullish candle. The final candle is a large bullish candle that closes above the high of the first candlestick.

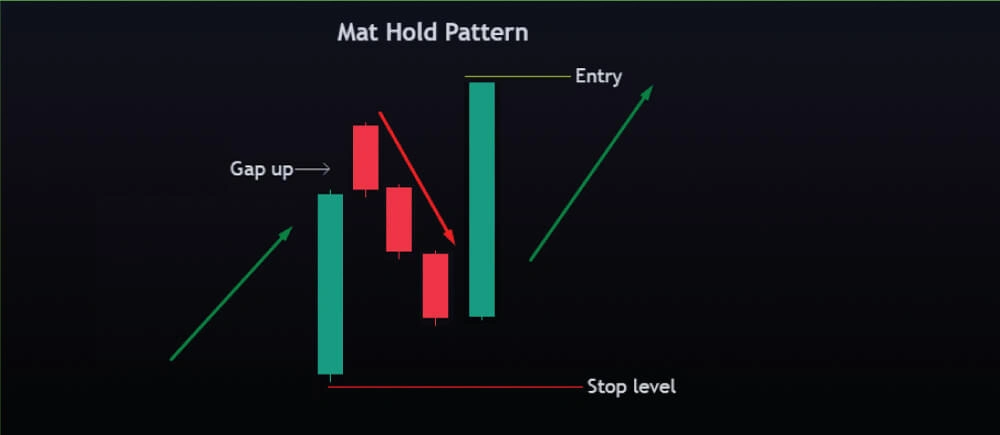

2. Mat Hold Pattern

Mat Hold pattern is a bullish continuation candlestick pattern comprising five candlesticks. Here’s how you can identify it.

This pattern begins with a long bullish candlestick in a sustained uptrend, followed by a gap. The second candlestick after the gap is a small-bodied bearish candle that barely covers the gap. It’s followed by two more bearish candles that don’t close within the body of the first bullish candlestick. The final candlestick in the Mat Hold pattern is a long bullish candle that closes above the trading range of the preceding four candlesticks.

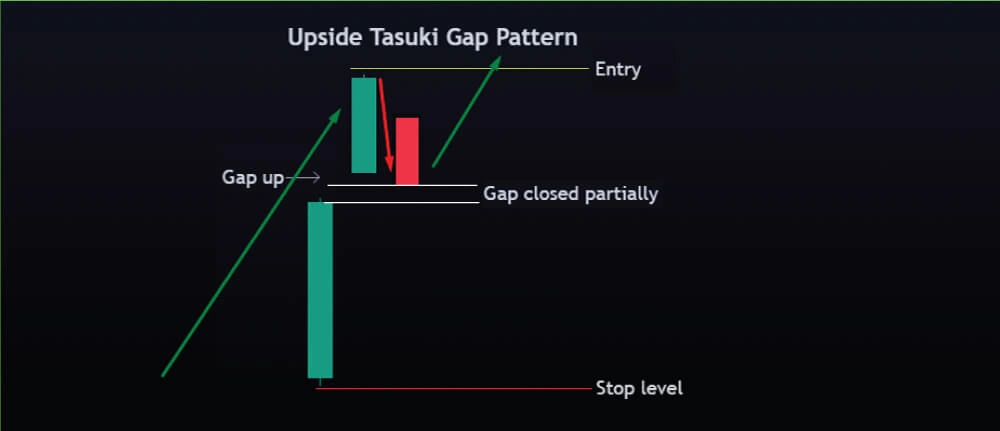

3. Upside Tasuki Gap

The upside Tasuki gap is a triple candlestick bullish continuation pattern. Here’s how you can identify it in a strong uptrend:

The first two candles in the upside Tasuki gap pattern are bullish candlesticks with a price gap between them. The third candlestick in the pattern is a bearish candle that opens within the body of the second candlestick and partially closes the gap.

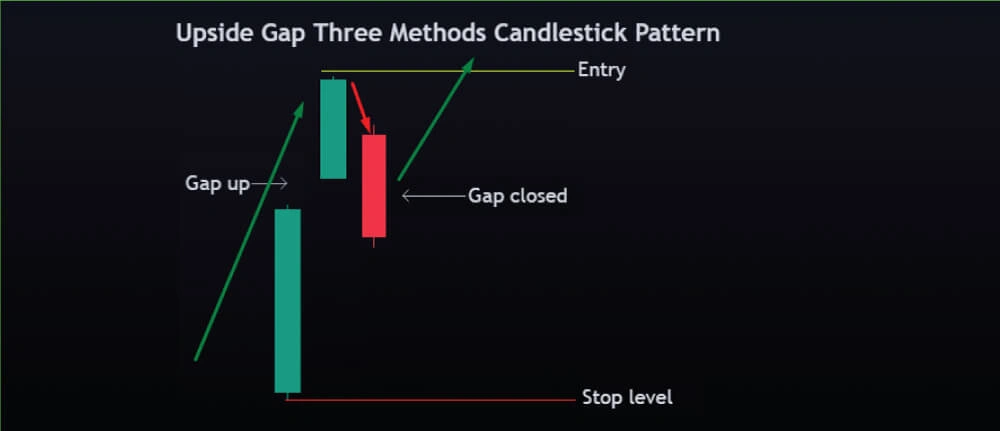

4. Upside Gap Three Methods Candlestick Pattern

The upside gap three methods is a bullish continuation candlestick pattern. It’s a triple candlestick chart pattern similar to the upside Tasuki gap pattern. The main difference between the two candlestick patterns is that the third candlestick in the upside gap three methods pattern completely closes the gap between the first two bullish candlesticks.

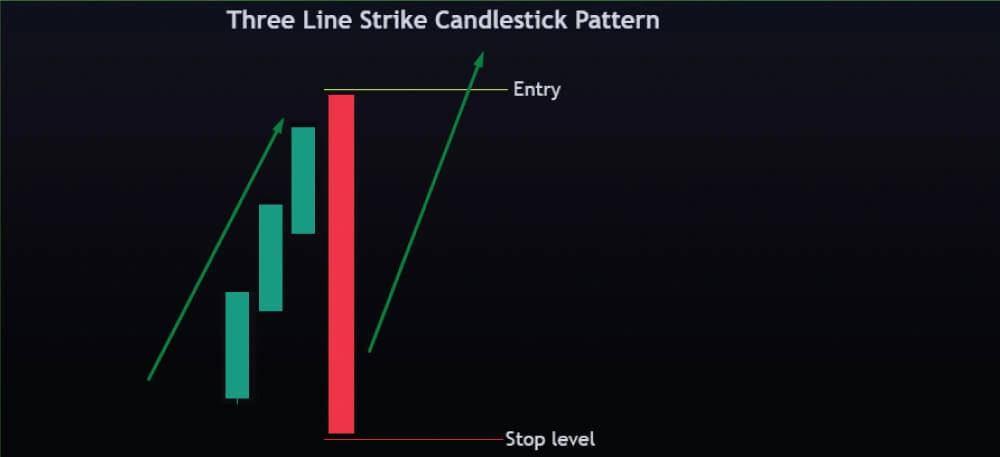

5. Three Line Strike Candlestick Pattern

The three line strike is a bullish continuation candlestick pattern consisting of four candlesticks.

The first three candles are strong, real-bodied bullish candlesticks of averagely similar size that close progressively higher and with higher lows, indicating a strong bullish trend. The fourth candlestick in the pattern is a long bearish candlestick that opens higher than the first three and pulls back to close below the first bullish candlestick.

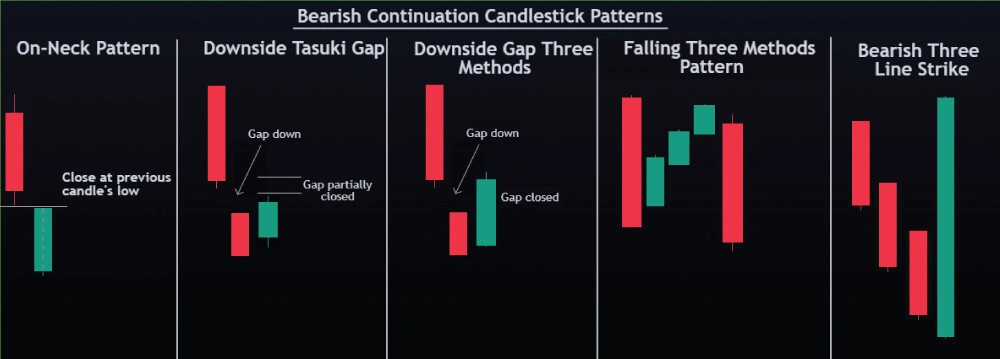

Bearish Continuation Candlestick Pattern

Bearish candlestick patterns form during a downtrend, signaling a temporary pause in the trend, after which the bearish trend may continue. Ideally, when bearish continuation candlestick patterns form, traders should look for setups to short the market.

Some top bearish trend continuation candlestick patterns include the falling three methods, bearish Mat hold pattern, downside Tasuki gap, on-neck and in-neck, downside gap three methods, and bearish three line strike.

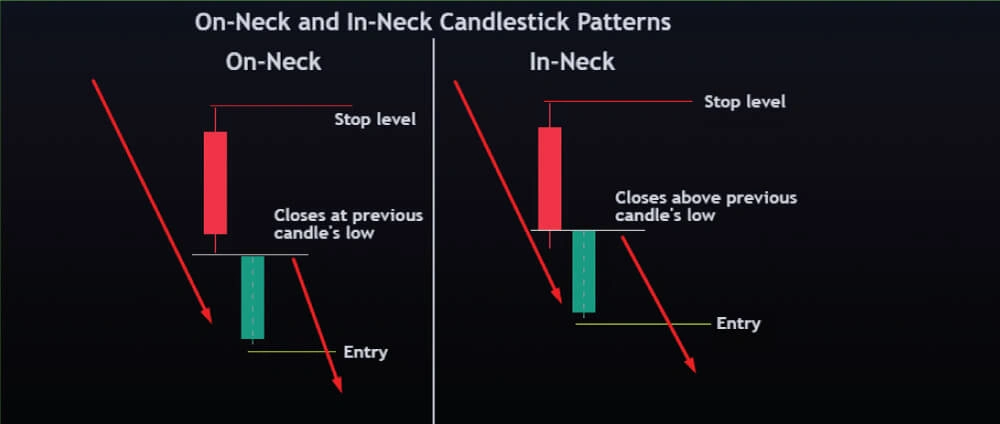

1. On-Neck and In-Neck Candlestick Patterns

The on-neck and in-neck candlestick patterns are bearish continuation patterns. Both are dual candlestick patterns consisting of a long bearish candle and a small bullish candlestick. The difference between the on-neck and in-neck candlestick patterns is the closing price of the bullish candle.

With the on-neck candlestick pattern, the opening of the second bullish candle gaps down but rises and closes at or near the lowest price of the first bearish candlestick. For the in-neck candlestick pattern, the closing price of the bullish candlestick is slightly above the lowest price of the first bearish candlestick.

Note that both on-neck and in-neck candlestick patterns signal that the downtrend will possibly continue despite a brief attempt at a trend reversal.

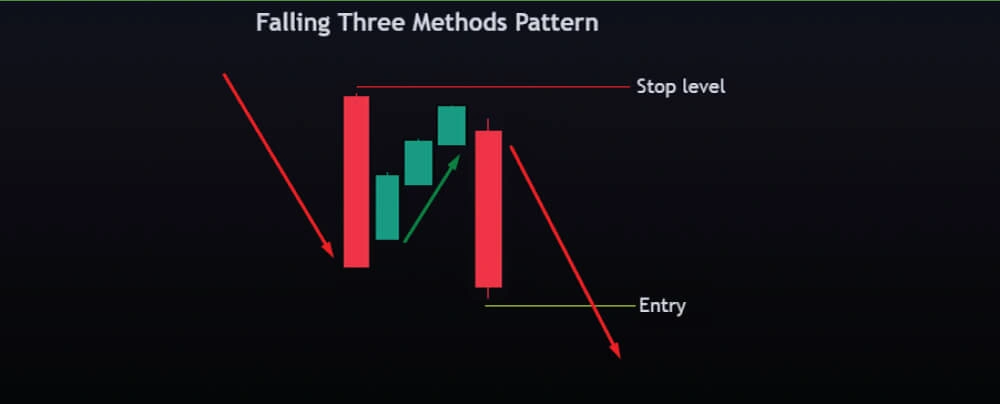

2. Falling Three Methods Candlestick Pattern

The falling three methods is a bearish continuation candlestick pattern. Although it’s a triple candlestick pattern, the falling three methods pattern consists of at least five candlesticks and usually occurs in consolidation during a strong downtrend. Three small bullish candles are sandwiched between two large-bodied bearish candlesticks.

The first candle in the pattern is a large bearish candle, followed by three smaller bullish candles, all contained within the body of the first candle. The final candle is a large bearish candle that closes below the low of the first candlestick.

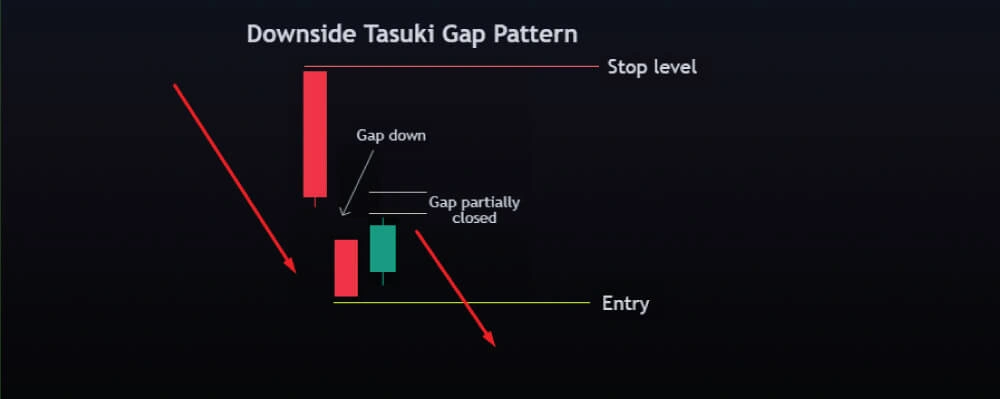

3. Downside Tasuki Gap

The downside Tasuki gap is a triple candlestick bearish continuation pattern. Here’s how you can identify it in a strong downtrend:

The first two candles in the upside Tasuki gap pattern are bearish candlesticks with a price gap between them. That means the second bearish candle opens below the close of the first candlestick. The third candlestick in the pattern is bullish and opens within the body of the second candlestick and partially closes the gap.

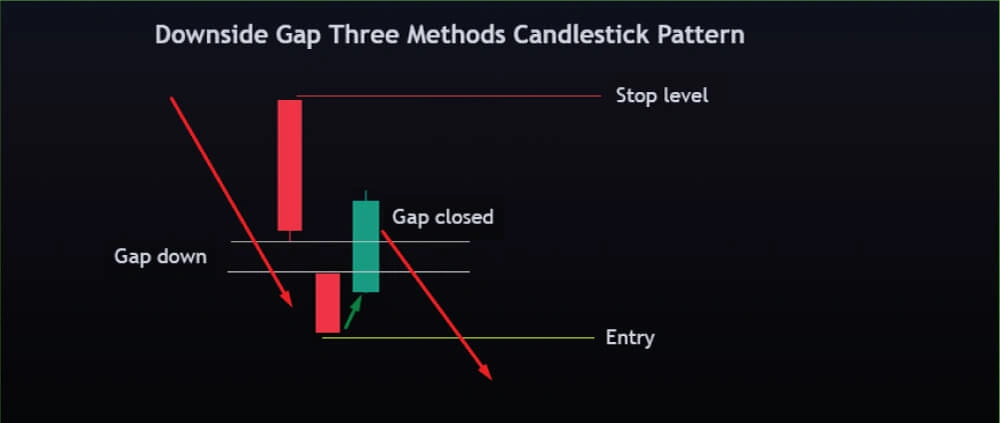

4. Downside Gap Three Methods Candlestick Pattern

The downside gap three methods is a bearish continuation candlestick pattern, made up of three candlesticks, and resembles the downside Tasuki gap pattern. However, unlike in the Tasuki gap pattern, the third candlestick in the downside gap three methods pattern completely closes the gap between the first two bearish candlesticks.

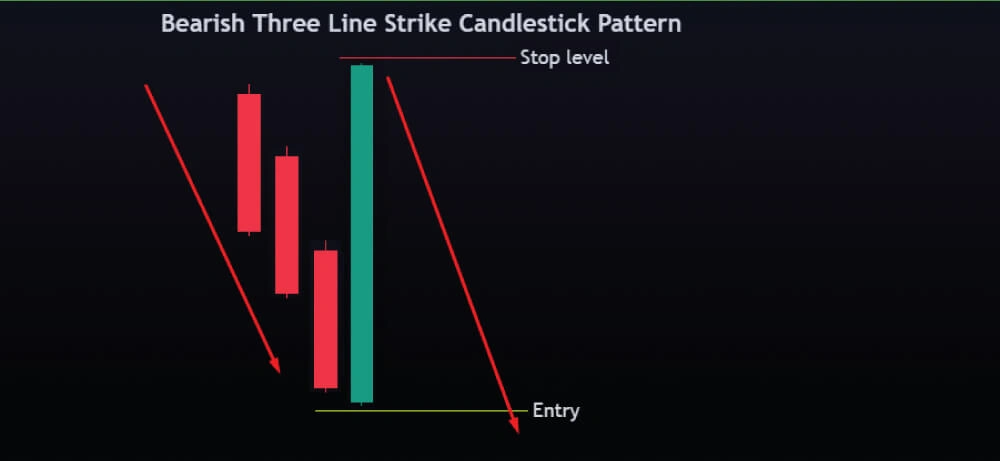

5. Bearish Three Line Strike Candlestick Pattern

The bearish three line strike consists of four candlesticks, signaling a possible continuation of the downtrend.

The first three candlesticks are long, bearish candlesticks almost similar in size. They close progressively lower with lower highs, indicating a strong bearish trend. The fourth candlestick in the pattern is a long, bullish candlestick that opens lower than the first three and rises to close above the opening of the first candlestick.

How to Trade Bullish and Bearish Continuation Candlestick Patterns

Structurally, candlestick patterns have built-in support and resistance levels. The pattern’s highest price is the resistance level, and the lowest is the support level. When trading bullish continuation candlestick chart patterns, the ideal entry is slightly above the pattern’s highest level. Your entry should be below the pattern’s lowest price for bearish continuation candlestick patterns.

You can place your stop loss slightly below the support level when opening long positions and slightly above the resistance when opening short positions. Finally, you can set the profit target based on market volatility measured by the ATR indicator.

The Bottom Line

Continuation candlestick patterns represent a brief pause in the dominant trend before the trend likely resumes. These patterns can be bullish or bearish. Bullish continuation candlestick patterns form during an uptrend and signal a potential continuation of the uptrend. On the other hand, bearish continuation candlestick patterns form during a downtrend and signal a possible continuation of the bearish trend.

Given that these patterns have easily identifiable support and resistance levels, you can use them to determine optimal entry in the direction of the dominant trend. However, it’s worth noting that candlestick chart patterns aren’t foolproof. So, when trading continuation candlestick patterns, always stick to strict risk management.