The Quant Operating System for Institutional-Grade Alpha

Tickblaze is the only quant-native platform designed to accelerate research, development, and deployment of trading strategies at scale. Built by quant engineers, for quant engineers, our platform combines multi-language coding, portfolio-level infrastructure, institutional data access, and OMS/OME execution into one seamless environment.

Why build in-house for tens of millions when Tickblaze can deliver in days what takes most firms weeks, at 1/10th the cost?

End-to-End Alpha Lifecycle — Fully Integrated

Tickblaze covers the entire lifecycle of quant strategy development:

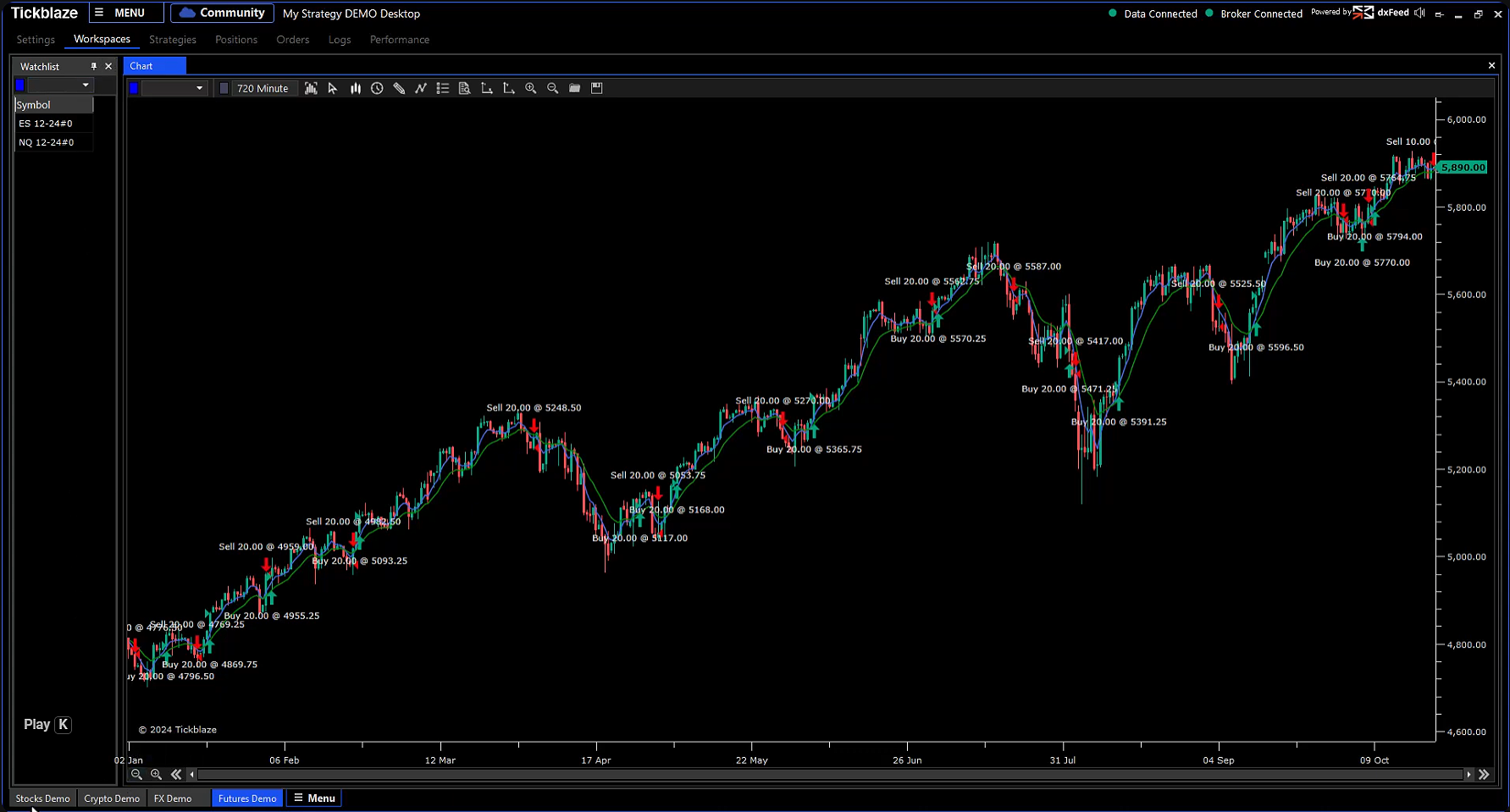

- Research & Modeling → Build in C# or Python (multi-language support)

- Backtesting & Validation → Institutional-grade historical testing with integrated data feeds

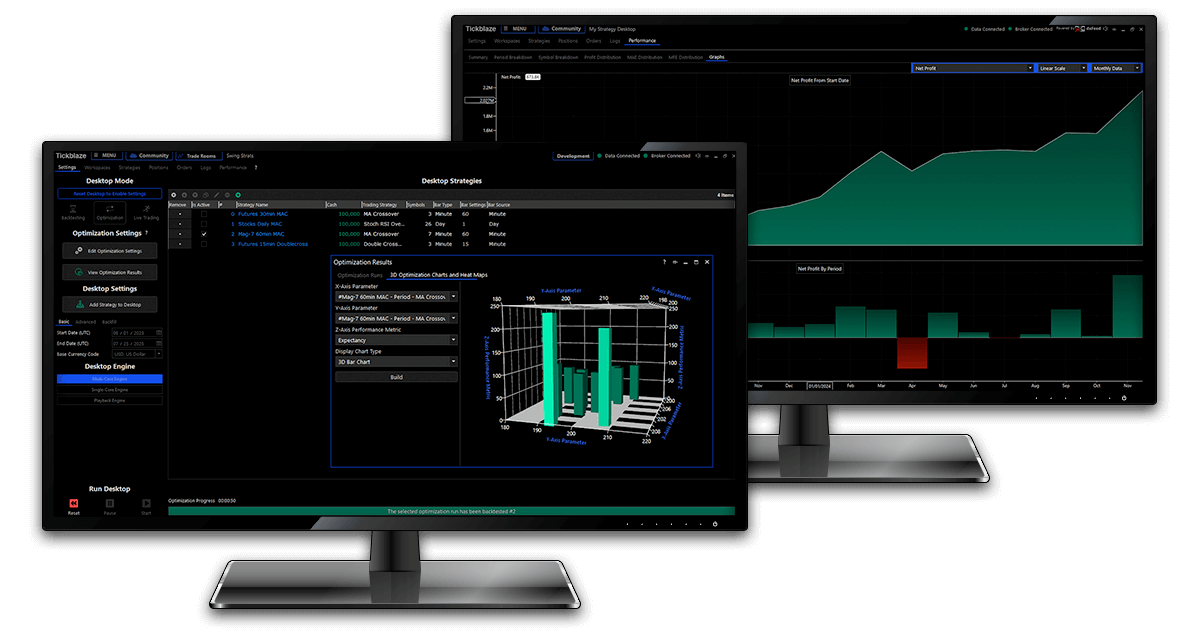

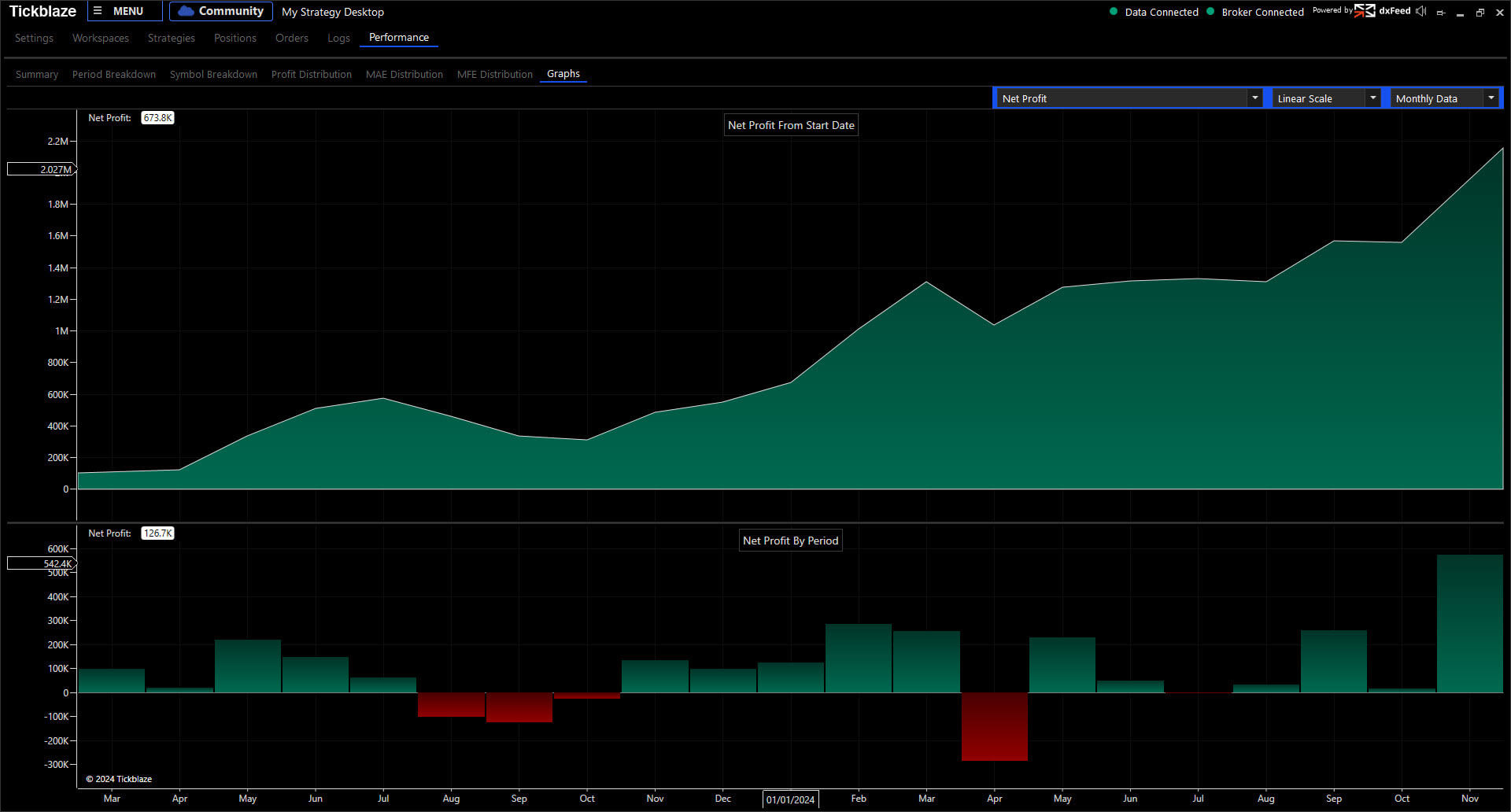

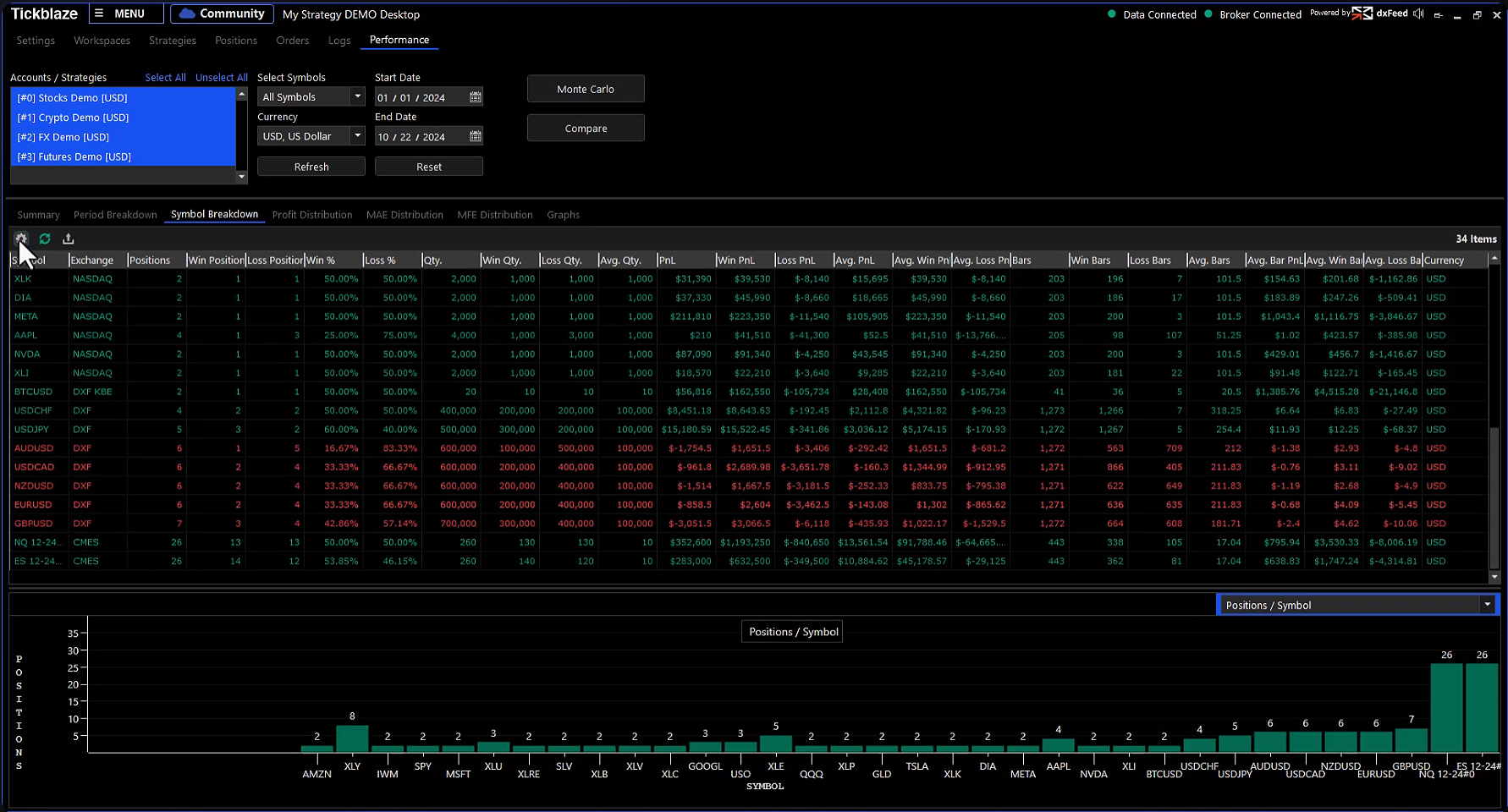

- Optimization & Portfolio Testing → Multi-strategy optimization across assets and portfolios

- Deployment → OMS/OME execution across multiple brokers and asset classes

- Performance Dashboards → Strategy-level KPIs, equity curves, MAE/MFE, trade distributions

No fragmented stack. No middleware layers. Tickblaze unifies the alpha pipeline in one enterprise platform.

Solving the Biggest Challenges for Funds

-

Human Capital

Bottlenecks Cut reliance on scarce, expensive quant developers. Tickblaze delivers what would take internal teams weeks — in days. -

R&D Budget Pressures

In-house quant stacks cost tens of millions and take years. Tickblaze provides an enterprise solution for a fraction of the cost, freeing capital for alpha -

Time to Market

Alpha opportunities decay fast. Tickblaze accelerates research-to-deployment, helping you seize opportunities before competitors. -

Lifecycle Fragmentation

Most funds patch together research engines, execution platforms, and risk systems. Tickblaze consolidates everything into a unified quant OS.

Core Features & Functions

Quant Infrastructure

- Portfolio-level strategy testing & live deployment (industry first)

- Multi-workspace, multi-broker, multi-asset support

- OMS/OME execution with simulation + live environments

- Built by quant engineers for institutional workflows

- CLI (Command Line Interface) for automation and integration with enterprise pipelines

Support & Enterprise Services

- Custom onboarding, trials, deployment assistance

- Dedicated developer assigned to each firm for coding/scripting support

- White-glove 24/7 support: phone, email, and dedicated chat (Slack, Teams, or custom)

- Direct communication lines to the CEO & CTO

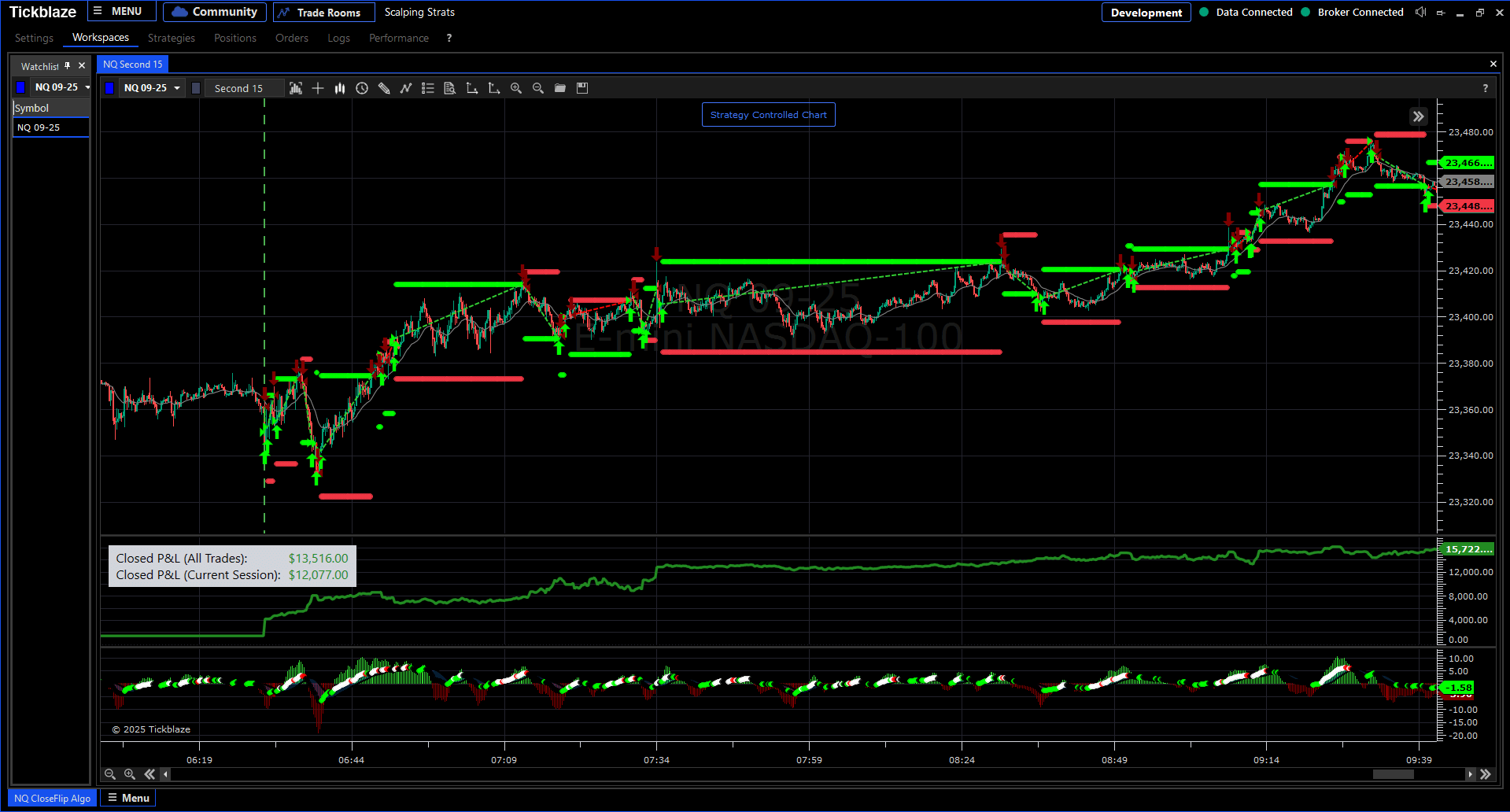

Live Strategy Deployment

- Cross-asset, cross-broker execution

- Sim-to-Live & Live-to-Sim trade copier

- Market replay for live-like forward testing

Universal Access. Unlimited Possibilities.

Tickblaze is a universal quant layer, integrating seamlessly with the global trading ecosystem:

- Data Providers: Direct integration with Databento, DXFeed, CQG, Rithmic, IQFeed, Polygon, plus custom data sources on request

- Execution Gateways: CQG, Rithmic, Interactive Brokers, PrimeXM, Centroid, OneZero, YourBourse

- Asset Classes: Equities, Futures, FX, Options, Crypto, Digital Assets

- Deployment Models: Desktop-first today, with hybrid cloud deployments coming soon

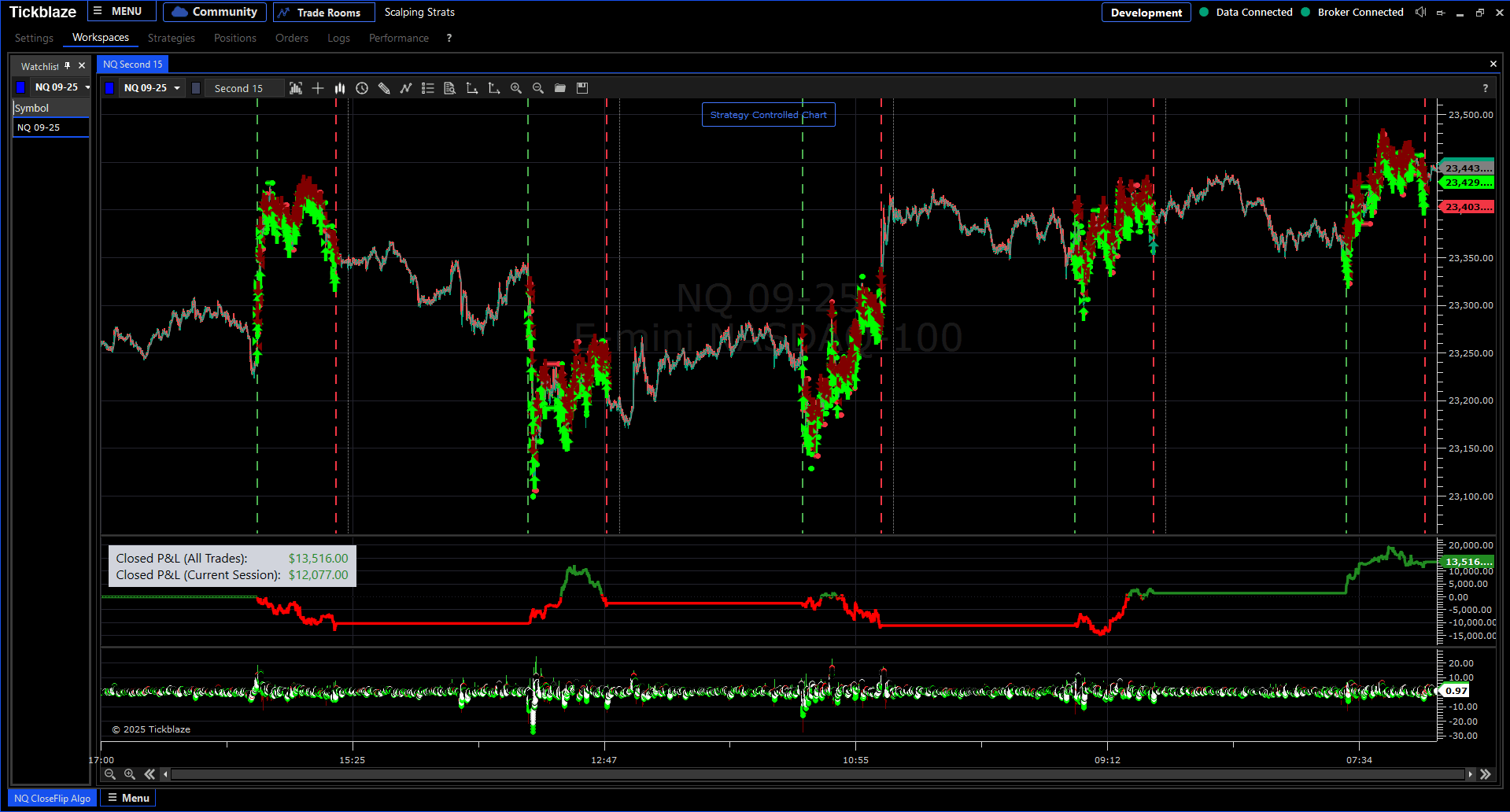

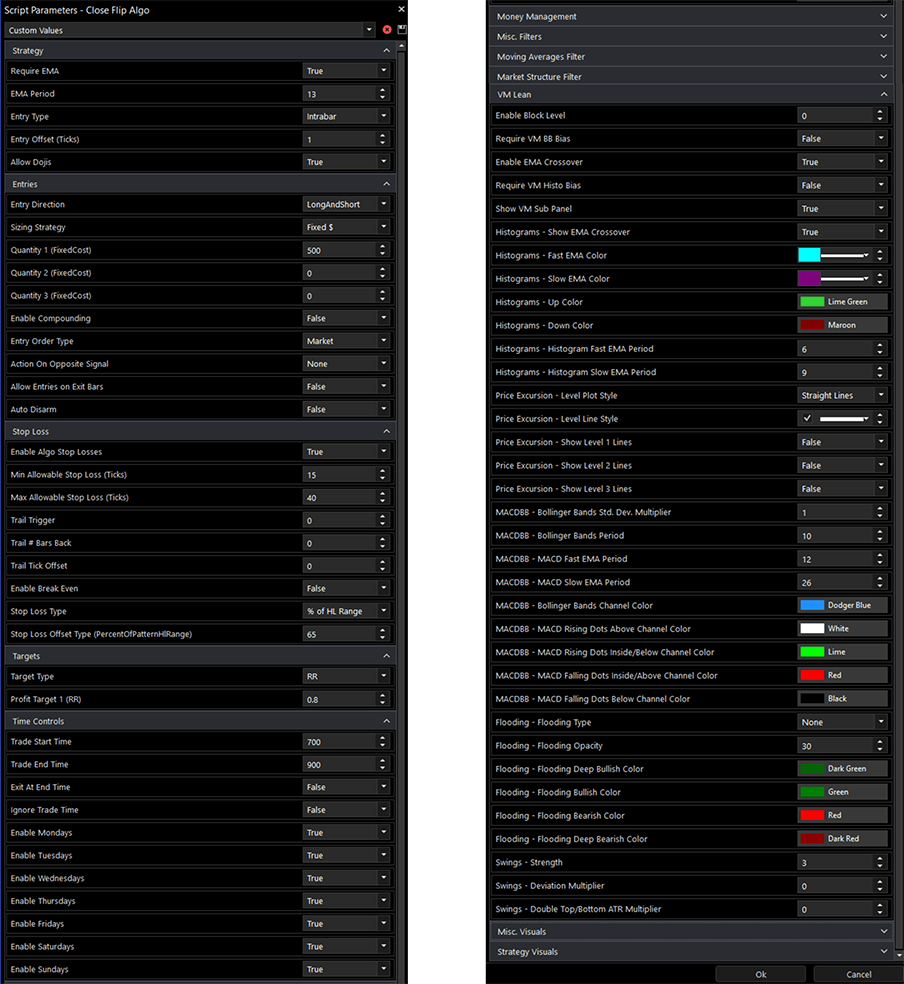

Secret Sauce: The Quant Algo Engine

Behind Tickblaze lies our proprietary Quant Algo Engine — a technology that took years and millions to develop, available only under developer licenses for quant funds.

This engine transforms unrefined strategies into systematic, more profitable trading systems by layering in advanced filters, execution logic, and money management controls.

Highlights of the Algo Engine:

- Algo-specific signal generation combined with universal filters

- Sophisticated entry management (long/short modes, market/limit, reversal logic)

- Advanced stop & target handling (ticks, ATR, risk/reward multiples)

- Money management modules with high-watermark logic, max loss controls, and profit resets

- Time-based controls (session filters, day-of-week, trade windows)

- Trade filters: moving averages, market structure, VMLean momentum oscillator, trend bias, and more

- Risk reduction: limits on overtrading, direction filters, breakeven and trail logic

The result:

Bad strategies are filtered, optimized, and rebuilt into profitable, institution-grade systems — all within the Tickblaze platform.

The Algo Engine is the backbone of Tickblaze, powering strategies that would otherwise fail and transforming them into scalable alpha-generating systems.

Scalable for Any Firm

- Emerging Quant Funds ($250M–$500M AUM): Reduce engineering overhead, shorten validation cycles, and focus capital on scaling.

- Mid-Size Hedge Funds ($500M–$2B AUM): Deploy portfolio-level strategies across brokers and assets, with integrated support.

- Large Multi-Strat Firms & Asset Managers ($2B+ AUM): Standardize research and deployment globally with enterprise licensing and dedicated white-glove support.

What Industry Leaders Are Saying

“Tickblaze accelerates quant research and deployment at a pace I’ve never seen. What takes a team weeks internally, Tickblaze delivers in days — with cleaner workflows and less overhead.”

— Former VP, Two Sigma

“For hedge funds managing large AUM, R&D is always a battle of cost versus speed. Tickblaze solves that equation. It’s the only quant platform I’ve seen that can scale across portfolios, asset classes, and coding languages without compromise.”

— Former Partner, JP Morgan

“At Databento, we partner with only the most innovative platforms. Tickblaze has built a quant infrastructure that seamlessly integrates institutional-grade data with a true portfolio-level quant stack. This is the future of alpha generation.”

— Founder & CEO, Databento

Enterprise Access Model

Tickblaze offers enterprise trial licenses for firms with $250M+ AUM. Trials convert into AUM-based enterprise agreements, aligning with firm growth and creating long-term partnership value.

Ready to Redefine Your Quant Edge?

Tickblaze is not just a platform. It’s your quant R&D department, your trading engine, and your alpha factory all in one.

Powered by the Tickblaze OMS/OME

Every Tickblaze deployment runs on a dedicated institutional trading engine designed for the realities of high-volume, multi-asset operations. Our OMS and matching engine handle the full order lifecycle with precise fills, real-time risk enforcement, and complete audit visibility. This eliminates the fragility of legacy OMS stacks that slow down under load, or trigger rules late.

With per-symbol engines, consistent P&L and drawdown tracking, and a unified flow across platform, risk, and back office, firms gain performance and stability that scale as they grow. It is the technology backbone behind the entire Tickblaze Prop/Broker/Fund ecosystem.